Abaxx Technologies (ABXX) - The Newest Commodity Exchange

Enabling the energy transition via physically settled commodity futures. The company is approaching an inflection point to significant revenue growth.

See updates and investor call notes in the Abaxx Technologies tag.

Note: All monetary figures are denominated in USD.

Highlights

Abaxx Technologies (ABXX) has recently received regulatory approval to launch the newest commodity exchange and clearinghouse in over a decade.

The company is developing new physically settled futures contracts for LNG, carbon, and nickel. Lithium and precious metals contracts are in development.

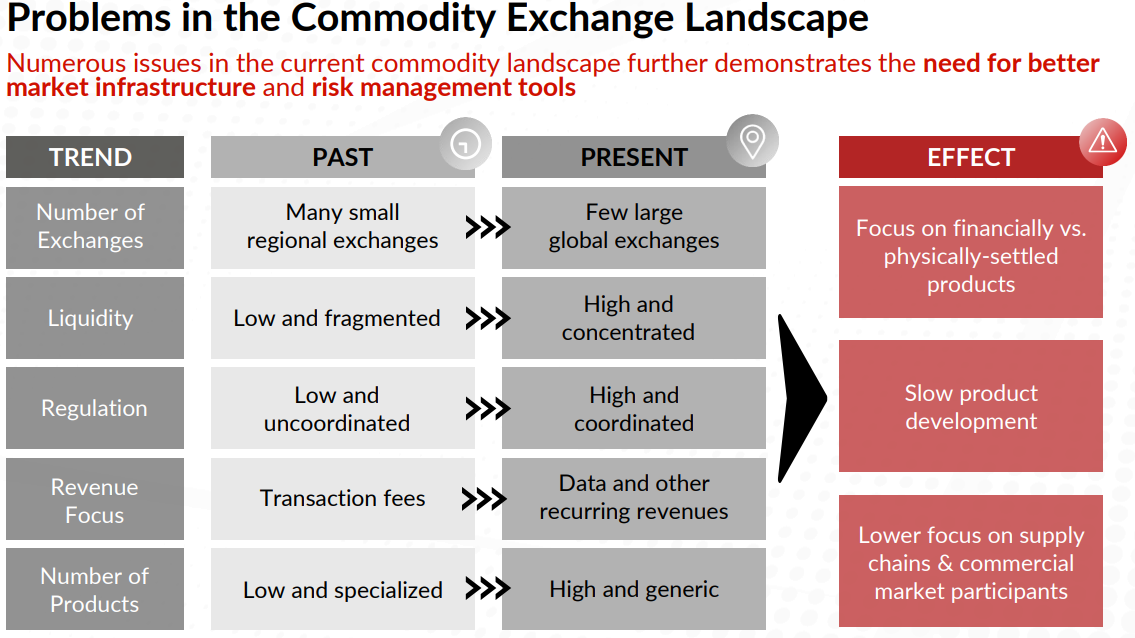

Existing competitors are content with maintaining the status quo. They’ve abandoned addressing market problems in favor of chasing investor returns.

Abaxx is revolutionizing the exchange industry with Web 3.0, blockchain, distributed ledger, machine learning, and other emerging technologies.

Commodity exchange operations and royalty generation lead to a capex-light and high-margin business model.

Investors in the company include BlackRock, Wellington, CBOE, Robert Friedland, and Lucas Lundin.

A DCF analysis of Abaxx’s futures contracts concludes they could be worth an NPV of $121 per share in aggregate by 2025. This represents an upside of 1,185% from today’s share price.

Stock Information

Name: Abaxx Technologies

Market Cap: $310M

HQ Location: Toronto, Canada

Tickers: ABXXF on the OTC, ABXX on the CBOE Canada.

Company Overview

Abaxx Technologies (ABXX) is a software and market infrastructure holding company. The business was set up in a way to enable the management team to create optionality through a variety of potential spin-out companies (while maintaining ownership stakes and royalties):

While I’ll provide an overview of all of their various business ventures throughout this write-up, Abaxx currently has two primary initiatives:

Abaxx Singapore: 88% ownership of a physically settled commodity futures exchange and clearinghouse they’ve built in Singapore. This will be Abaxx’s main source of revenue. As we’ll discuss, this is a rare asset.

Abaxx Technologies (ID++ suite): Development of self-sovereign digital identity applications, distributed ledger, machine learning, and other emerging technologies.

Note: When you buy stock in Abaxx Technologies, you’re buying Abaxx Technologies Inc., which is the holding company. Abaxx Technologies Corp. is the subsidiary dedicated to ID++ technology development.

Market Opportunity

The company’s goal is to improve commodity markets that are underserved by existing commodity exchange and infrastructure operators (CME, ICE, LME, etc).

In an effort to prioritize profits, these companies have slowly abandoned their focus on addressing the underlying problems found in the futures markets they serve.

This has led to less of a focus on physically settled futures contracts and more offerings of financially settled contracts. The difference is, a buyer of a physically settled contract can take physical delivery of the underlying commodity associated with that futures contract. For example, one of Abaxx’s nickel futures contracts correlates to 5 tonnes of nickel. So the buyer of that contract would take delivery of 5 tonnes of nickel from the seller upon expiration.

A financially settled contract is purely cash-based, with no expectation of physical delivery. These contracts are easier to establish, given financial settlement doesn’t require much, if any, additional market infrastructure.

Abaxx has been developing its exchange for over five years, which shows just how complicated it can be to set up a physically settled exchange. That work serves as a moat against new potential competitors, as well as the larger existing operators who could try to compete with Abaxx.

Jennifer Ilkiw, president of ICE Futures US (Abaxx’s second largest public competitor), told John Lothian in an interview that it can take ICE two or two and a half years to develop a physically settled futures contract.

Terry Duffy, CEO of CME Group (Abaxx’s largest public competitor), informed the Financial Times that the company wouldn’t create its own nickel contract, even going so far as to say it “would be difficult” to do so. The difficulty stems from the use of physical delivery. That’s a market Abaxx is already launching products in.

Clearly, the giants in this space are perfectly fine with following the status quo. Rather than trying to compete, the more likely option is that either CME or ICE will eventually try to buy out Abaxx if they succeed. Abaxx’s management has larger plans than just developing a commodity exchange (which we’ll discuss later), leading me to believe they’re unlikely to entertain a buyout offer unless it’s too good to ignore.

As things currently stand, some of the commodity markets Abaxx is launching in are too small for the large incumbents to even worry about. Targeting relatively niche battery metal markets isn’t worth the effort. On the other hand, Abaxx is significantly smaller, so catering to the unmet demand in these sectors can make sense right now.

Once Abaxx dominates these niche markets, creates benchmark futures contracts, and gains the trust of market participants… it can expand into more competitive commodity futures products. This is similar to what Peter Thiel describes in his book on establishing start-ups: Zero to One. Thiel explains the key points in this video. Josh Crumb, the CEO of Abaxx, has retweeted this clip before.

Strategic Vision

The company’s key focus is on developing its commodity exchange, but management has teased a few other long-term goals:

Use the exchange as a trojan horse to introduce new technologies (ID++) to an industry that’s known for slow technological adaptation.

Digitized warehouse receipts could create “green premiums” by better tracking how a commodity was produced. Buyers could choose to prioritize products sourced in cleaner ways, without slave labor, etc.

Via improved tracking and information verification through blockchain technology, commodities could be used as collateral for lending.

LNG Markets

Abaxx’s flagship product is a liquified natural gas (LNG) futures contract. While it’s up for dispute how low the emissions rate ends up being… in theory, the usage of LNG leads to 40% less GHG emissions than coal. This leads to the view that LNG can be used as a transitionary fuel away from more carbon-intensive sources.

As of 2023, global LNG trade had reached 404M metric tons. Shell estimates demand for LNG will rise by at least 50% by 2040. Approximately 2-5% per year. The primary source of this growth has been from countries in Asia, hence Abaxx’s choice to build out their exchange in Singapore.

As an illustrative example of what an LNG contract might be worth in the future, Abaxx’s management is confident (timestamp -13:50) that once the contract matures, it could generate hundreds of millions in revenues like Henry Hub or WTI.

There’s currently no physically settled benchmark for the LNG market. It’s the only fossil fuel that doesn’t have one— this used to work because the vast majority of trading in the LNG market took place through long-term contracts. That’s no longer the case.

According to S&P Global, by the end of 2023, spot LNG trading was 36.6% of the market. While growth in spot trading has slowed over the last few years, there’s still a general trend to move away from long-term agreements.

To deal with price hedging, firms are forced to use inefficient price assessments or derivatives of crude oil and natural gas futures contracts. These include products like the Japan Crude Cocktail (JCC), Japan Korea Marker (JKM), or Dutch Title Transfer Facility (TTF).

With no dedicated LNG benchmark on which to base market trading, market participants have resorted to using various alternatives. None of them can lead to adequate price discovery.

Currently, hedging isn’t effective because you have to use contracts based on entirely different commodity markets, or financially settled contracts with no threat of offtake.

The only way to truly know what the price of LNG is— would be to see what price a futures contract settles at upon physical delivery of that commodity. In addition, building out an applicable futures pricing curve to better hedge risk.

As spot trading has grown in volume, trading firms are demanding new solutions.

Why CME Group Failed

While the LNG market currently has no benchmark… Abaxx isn’t the first company to try creating one. CME Group, the largest commodity exchange operator in the world, launched its own physical LNG futures contract in 2019.

The Gulf Coast LNG Export futures contract is based in the United States, with possible delivery locations in Sabine Pass and Freeport LNG, among other areas.

To my knowledge, the contract currently has zero volume and has never been traded.

What happened here, and why wouldn’t the same thing happen to Abaxx?

Jamison Cocklin from Natural Gas Intelligence outlined several possible reasons for CME’s failure:

The contract size of 10,000 MMBtu. Covering an entire LNG cargo requires relatively large physical volumes. Since an entire cargo is approximately 3.5 Bcf of natural gas, that equates to around 340-350 futures contracts. Building exchange liquidity takes time.

Shipping costs from the Gulf Coast. Depending on market conditions, LNG transportation freight rates can represent as much as 30% of the cargo’s total cost. In a free-on-board (FOB) contract structure, ownership of an LNG cargo is transferred from the seller to the buyer as the LNG is loaded onto a ship. So the buyer has to incur the subsequent shipping costs. Without a great way to hedge that risk, traders might’ve been disincentivized from using the contract.

Europe has a more fleshed-out market, with a better balance of buyers and sellers. There might’ve been more interest in an LNG contract in other regions of the world.

By comparison, Abaxx has taken an additionally thorough approach. Instead of simply launching the contract and hoping market participants use it… the company is coordinating block trades early on. This ensures that the exchange can build up initial liquidity to avoid the futures contracts being dead on arrival. Abaxx’s LNG contract is the same size, 10,000 MMBtu.

Even better, 43 different trading firms have already signaled their intentions to trade Abaxx’s futures products. The company developed said products with over 100 different firms to guarantee that market participants would be satisfied with the contract specifications.

I assume that if hedging shipping costs were an issue, Abaxx would already offer LNG freight futures as a product at launch. The fact that they aren’t leads me to believe it’s not a concern.

Lastly, Abaxx isn’t just launching a contract in the United States. They’re also offering physical delivery contracts via locations in Europe and Asia, covering all major LNG markets.

With the addition of these other contracts, they may price in the shipping costs from the US, given the US is the largest exporter of LNG. This could potentially negate the need for Abaxx to offer freight LNG contracts specifically.

Voluntary Carbon Markets

In addition to creating a benchmark futures contract in the last fossil fuel market without one, LNG… Abaxx is looking to do the same in another emerging market. The voluntary carbon markets (VCMs) are set to benefit massively from the trend toward net zero climate commitments.

Governments and corporations are setting green targets. The Science Based Targets Initiative (SBTi), backed by the United Nations, is the largest verifier of climate targets. The organization tracks 8,200 companies in total. 5,100 of those companies have declared science-based targets that SBTi has approved. 3,000 of them have committed to reaching net zero over various timelines.

This all sounds nice, but there’s one big problem… how are they actually going to completely decarbonize? “Hard-to-abate” emissions account for approximately 30% of greenhouse gas emissions. These include industries like cement, steel, trucking, aviation, etc. Reducing CO2 output in these processes will be significantly difficult. Chances are, O&G usage is not going away for decades, if it ever does.

That’s where the voluntary carbon markets come in. Offsetters can buy carbon credits (a certificate signifying 1 abated ton of CO2) from carbon projects tracked by carbon registries.

VCMs are currently valued at $2B and expected to grow rapidly through 2030:

The Berkeley Carbon Trading Project (BCT) maintains a database, updated yearly, containing all supply and demand figures from the top five carbon registries:

Verra (VCS)

Gold Standard (GOLD)

American Carbon Registry (ACR)

Climate Action Reserve (CAR)

California Air Resources Board (ARB): This registry is slightly different because ARB specifically registers projects to participate in the California ETS, which is a compliance carbon market, not voluntary. Regardless, their numbers are included.

Combined, these registries account for the vast majority of trading activity in the carbon markets. So, we can garner general supply and demand trends from this data.

According to BCT data from 2022/2023, carbon credit issuances (supply) were approximately 280M tons per year. By contrast, carbon credit retirements (demand) were near 160M tons per year. I went over this data in more detail in this video if you’re interested.

Carbon project types with the largest number of issuances by market share were:

REDD+ - 24.1%

Improved forest management - 10.9%

Cookstoves - 5%

Landfill methane - 4.9%

Afforestation/reforestation - 3.1%

Renewable energy is technically the highest, but those methodologies are being removed from the VCMs over time, so they should be ignored.

If you want to bet on what other carbon credit types Abaxx might launch new futures products for, I would bet on these. Every project type is a possibility because there aren’t any existing benchmark futures contracts in the VCMs. Most trading activity is done through OTC trades. This leads to opaque markets, poor price discovery, and few options for risk hedging.

Abaxx has announced its first two carbon credit futures contracts will be:

JREDD+ - Jurisdictional deforestation and forest degradation is one of the most prevalent project types in the carbon markets. These credits can be sourced under the registries Verra or TREES Standard.

CORSIA Phase One - CORSIA stands for the Carbon Offsetting and Reduction Scheme for International Aviation, and the operation is managed by the International Civil Aviation Organization (ICAO). The program is dedicated specifically to airlines and requires them to monitor, report, and offset their emissions. CORSIA sources credits from its certified carbon registries. These include Verra, Gold Standard, and others.

CORSIA is anticipated to mitigate an annual average of 164M tons of CO2 from 2021 to 2035. Phase One is a voluntary participation phase of CORSIA from 2024 to 2026. From 2027 and beyond, most airlines are required to offset their emissions.

These two futures products were likely chosen because they’ll have the most liquid markets with adequate supply. Hundreds of millions of tons yearly, combined, as the VCMs grow and migrate to exchange trading.

As far as competition is concerned, Abaxx will need to compete with CME and ICE for market share, they’ve already launched similar products.

Both incumbents have agriculture, forestry, and other land use (AFOLU) futures products. AFOLU includes the following methodologies:

Afforestation, Reforestation and Revegetation (ARR)

Agricultural Land Management (ALM)

Improved Forest Management (IFM)

Reduced Emissions from Deforestation and Degradation (REDD)

Avoided Conversion of Grasslands and Shrublands (ACoGS)

Wetlands Restoration and Conservation (WRC)

We can see that REDD is included in this grouping of project types, but Abaxx is the only one focusing on that one market specifically. That’s necessary for real price discovery. These various projects are certainly not all the same. CME and ICE are offering broader “nature-based solutions” contracts.

Liquidity can be a double-edged sword, at times. Pricing in these exchange-traded carbon credit futures products has been decimated since late 2021. Prices via OTC trading tend to be significantly higher than what the CME is showing above.

CORSIA-based futures contracts are also being offered by both CME and ICE.

Overall, the carbon markets will likely offer the most competition of any market they’re entering at exchange launch. Market participants will determine who ultimately designed a contract worth using as a pricing benchmark.

Either way, Abaxx should get some volumes on its carbon credit contracts thanks to its LNG efforts. An additional selling point of using Abaxx’s LNG contract is offsetting the emissions of an LNG cargo. The exchange offers buyers the ability to add on carbon contracts while buying LNG contracts at the same time.

Product Pipeline

New solutions are needed not just in the LNG market but across the commodity landscape. Abaxx’s CEO has previously commented that any commodity market could be up for grabs at some point, but the disclosed futures contracts being developed are:

Contracts ready at launch:

LNG - Three futures contracts with physical delivery in various locations throughout Europe, Asia, and the United States.

Carbon credits - Two futures contracts, JREDD+ and CORSIA Phase One.

Nickel sulfate - Three futures contracts with physical delivery in Singapore, Rotterdam, and Baltimore.

Baltimore's delivery point has been disrupted by the collapse of the Francis Scott Key Bridge.

Contracts in development:

“Precious metals solutions” - Stage 3 (industry review/risk/regulatory).

Their press release wording specifically refers to them as solutions, so this will entail more than just futures.

Josh Crumb recently confirmed that Abaxx is looking to launch an Asian-based gold pool priced in kilo bars.

Lithium carbonate - Stage 2 (scoping/design/drafting).

All of these markets either have no established physical benchmark, or the solutions that are available have been deemed unsatisfactory by market participants.

Abaxx’s management knows there’s demand for these products; the market is actively approaching them for new contracts. As mentioned earlier, over 100 different trading firms provided input through working groups while developing their futures.

The company regularly coordinates with industry veterans for input:

Abaxx has a former senior member of Glencore, who previously had one of the largest base metal books in the world, working on Abaxx’s battery metal contracts.

A former chairman of the London Bullion Market Association (LBMA) is working on their precious metal contracts.

One of the company’s key goals is to help enable the energy transition. That means Abaxx’s immediate pipeline of new futures contracts will primarily consist of commodities in the base/battery metals sectors.

The demand for these metals is primarily driven by the world's electrification and the modernization of developing nations. Electric vehicles, renewable energy sources, battery storage, computing power… the list goes on. A variety of trends contributing to significant demand growth in these areas. With increased consumption, comes a greater need for risk mitigation tools. That’s where Abaxx comes in.

Competitor in Metals Futures

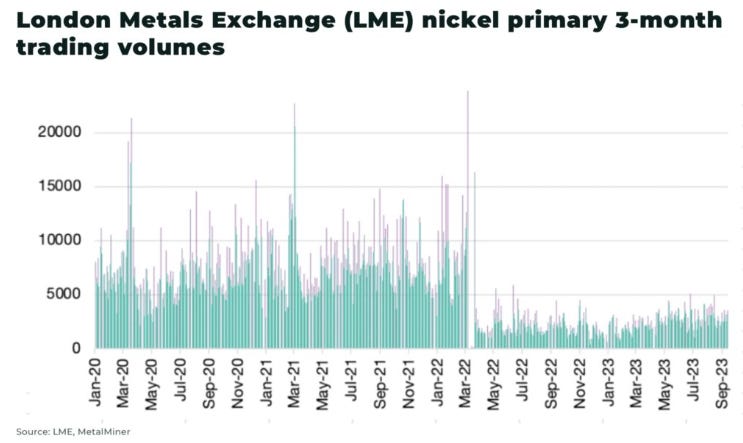

Abaxx’s primary competitor in the metals space will be the London Metals Exchange (LME). Luckily for Abaxx, the LME has been embroiled in scandals after the Russian invasion of Ukraine.

Market volatility in March 2022 forced the LME to halt trading in nickel markets.

Tsingshan Holding Group, a multi-billion mining and steelmaking company, had opened a massive short position on nickel. As prices skyrocketed, the company was sitting at more than a $10B loss. They were on the brink of bankruptcy.

The LME itself was in trouble, worried that panic might cause the entire market to collapse. A dozen different banks and brokers were at risk. So, the LME canceled all transactions and suspended trading, infuriating market participants.

Safe to say the LME has been struggling to regain the market’s trust. With that said, they have seen a bit of a resurgence in trading activity more recently:

The nickel volatility issues weren’t LME’s only issues in the space. LME warehouses were implicated in two different instances where nickel that belonged to JPMorgan and Trafigura turned out to be bags of stones.

Metal markets are generally prone to scandals and fraud. At the moment, warehouse receipts (proof of commodity ownership) are easy to manipulate.

For example, large banks lost hundreds of millions of dollars in these two high-profile scandals:

“It’s a pervasive problem,” said John Barlow, a partner at Holman Fenwick Willan LLP who advises insurers of banks on risks including trade financing. “There’s an inherent risk in transacting business in this way, and banks face the choice of either accepting that risk, or completely restructuring the way the industry operates.”

Abaxx couldn’t ask for a better opportunity to offer new solutions for firms disillusioned with existing products.

Nickel Types

It’s worth noting that the LME trades a different variation of nickel than Abaxx. The LME offers futures contracts that primarily deliver nickel briquettes, aka pure nickel. The metal has to be 99.8% pure or greater. This is referred to as Class 1.

On the other hand, Abaxx will offer a contract with pricing on Class 2. The traded product will need to be at least 22.1% nickel, with limits on exposure levels to other metals. Nickel sulfate usage is rising particularly quickly because it’s involved in the creation of batteries for electric vehicles.

While nickel sulfate consumption currently accounts for around 5% of total market demand, according to S&P Global Market Intelligence, it could grow to 35% by 2030.

While not directly competing with the LME on this contract, Abaxx can quickly assert dominance over a relatively niche but rapidly growing market. No one else is offering a nickel sulfate contract.

Commodity Exchange Rarity

In December 2023, Abaxx received their Approved Clearinghouse (ACH) and Recognised Market Operator (RMO) licenses from the Monetary Authority of Singapore (MAS). This marked a turning point for the company, signifying the completion of every major hurdle to launching their exchange.

At this point, Abaxx has set up all systems and infrastructure to trade futures contracts. The company is currently coordinating block trades to ramp up initial liquidity on the exchange.

To emphasize how rare of an asset a fully integrated exchange and clearinghouse can be… Abaxx is now operating the only one dedicated to physically delivered commodity futures in the Asia-Pacific, outside of China.

With its own clearinghouse, Abaxx doesn’t have to outsource transaction processing. Additionally, the vertical integration of Abaxx’s technology stack allows the company to launch new products at a faster pace than it otherwise could. They’ve brought as much of the market infrastructure in-house as they can.

Exchange Participants/Infrastructure

Note: Any secondary bullet point is the relevant entity involved within Abaxx’s ecosystem.

Buyers and sellers: Trading firms, commodity producers, speculators, and so on. Anyone looking to hedge risk or profit from potential pricing movement in commodity markets.

Broker-dealer: A person or firm buying and selling products on behalf of their customers.

Carry brokers (CB): Firms providing supplemental clearing services through an existing FCM.

Marex Group and ABN AMRO (could be FCM).

Clearinghouse: Acts as a buyer to a seller and a seller to a buyer, mitigating counterparty credit risk. Processes financial transactions and settles clearing member financial obligations (margin, physical delivery, collateral withdrawal).

Abaxx Clearing is 100% owned by Abaxx Singapore.

Exchange: Software provider facilitating a trading platform for buyers and sellers through rule-based order matching. Coordinates transactions between market participants. Designs products in consultation with industry stakeholders.

Futures commission merchants (FCMs): Also known as clearing members. FCMs solicit trades, collect margin, and ensure asset delivery.

StoneX, KGI Securities, Mizuho Group (could be CB), and another unnamed firm currently being onboarded.

Independent software vendor (ISV): Software provider that allows market participants to trade the exchange’s products on separate applications through API connections.

Trading Technologies, CGQ, FIS, ION.

Interdealer broker (IDB): Facilitates transactions between investment banks, broker-dealers, and other market participants. IDBs specialize in organizing block trades and collecting relevant trading data.

Vanir Global, Sweet Futures, TP ICAP, Eagle Energy, Marex Group, BCG Group, Amerex Brokers.

Price assessment agencies: Organizations that assess the going market price of commodities daily by surveying market participants and tracking transactions. These agencies publish their assessments, and market participants use them to settle contracts tied to pricing in financially settled markets.

Regulator: Governing body providing rules and regulations for exchange operators, among other infrastructure providers.

Monetary Authority of Singapore.

Settlement bank: Provides collateral management services and establishes bank accounts for the FCMs/clearinghouse at an exchange. Collects cash deposits, margin, and any other funds which constitute collateral.

DBS Bank Limited and Standard Chartered Bank.

Third-party software providers: Software for exchange middleware that improves exchange trading, post-trade services, and risk management capabilities.

Exberry, Baymarkets.

Warehouse: Often, a commodity exchange will have transacted material stored in holding areas, if applicable.

Abaxx isn’t currently using warehouses since it opted for an immediate, direct delivery model upon contract expiration in the metals space.

Abaxx Technologies (ID++)

Investors tend to discount the technology side of this business. It’s essentially impossible to value right now. After all, the focus of development for the past five years has been on the exchange. We know relatively little about Abaxx’s technology development roadmap.

That said, Jeffrey Currie, the former global head of commodities research at Goldman Sachs, has noted that he thinks the technology Abaxx plans to roll out could actually be as big or even bigger than the exchange itself…

So what do we know about their technology platform?

Abaxx has 11 patents (4 issued, 7 pending) on different use cases for blockchain, distributed ledger, and tokenization in commodities trading.

No other exchange operator offers anything close to what Abaxx is developing in this realm. For reference, the CME Group just recently completed migrating its data to the cloud in a partnership with Google. It’s difficult for these existing incumbents to alter their systems to utilize new technology. A key advantage for Abaxx, who’s building from the ground up.

The company is embracing Web 3.0 and decentralized finance. In essence, Web 3.0 marks a movement away from big technology companies owning the data their users generate. Instead, data is held in decentralized networks where only the user can choose which entities can access it.

Abaxx has built a variety of open protocol, self-sovereign digital identity applications. These apps are referred to as the ID++ suite, also known as the Abaxx Console:

Verifier - A secure password, digital identity, and verification application. Think of a mixture of authenticator apps or secure document signing like DocuSign. Abaxx’s version will be more secure because of cryptography technology.

Drive - Serves as a personal, private storage system. Every request for access, reading, or writing new records is recorded in a distributed ledger. Akin to Box, but more secure.

Vault - An extra layer of security on top of Drive for more sensitive private information. Storage of identification, digital assets, or records.

Messenger - A messaging platform that offers text, voice, and video capabilities. Akin to Instant Bloomberg or Slack. All messages are end-to-end encrypted and stored in Drive or Vault to ensure that data isn’t exposed. Thanks to Verifier, the credentials of anyone a user communicates with can be proven easily.

Looking at the market cap valuations of these applications, DocuSign ($11B), Box ($4B), and Dropbox ($8B)… we could see how ID++ could be worth billions, assuming these applications garner market adoption. That’s the issue, though. Until we know what users think of this software, and Abaxx’s plan for monetization, it’s difficult to ascribe any value to the technology.

The use of these applications ties into the upgrades made to warehouse receipts through Abaxx’s technology. Warehouse receipts, as they stand today, whether on paper or electronic, are susceptible to fraud. These are the records provided to contract buyers that can be traded in at a warehouse to take delivery of physical goods.

The warehouse receipts can be lost, forged, double-pledged, etc. If you introduce the blockchain (smart contracts) into this system, then you can track these commodities and transactions on a distributed ledger. This eliminates the potential for fraud and enables additional visibility into the characteristics of that individual commodity.

For example: who owns a gold bar, where it came from, how it was mined and produced… all of these aspects can be easily verified by tracking the specific serial number attributed to each individual gold bar. The existing system doesn’t allow for this type of detailed supervision.

The exchange technology is built on top of Bitcoin’s blockchain via the Lightning Network, using a combination of ION and IPFS.

Abaxx has emphasized that the exchange middleware (aka ID++ and other software) is blockchain agnostic. All of the applications can be transferred onto other crypto platforms relatively easily. We know this is the case because they’ve already done it once. The initial plan was to use Ethereum for the smart contracts; now they’re using Bitcoin through the Lightning Network.

Additional Technologies

Project Venice: A combination of ID++ applications into a prototype product dedicated to connecting qualified firms in the voluntary carbon markets. Abaxx completed a demo of the pilot project in Q4 2023.

ML/AI Applications: Large language models (LLM), among other AI use cases that can more efficiently organize exchange trades, reduce emissions from commodity transportation, etc.

Business Model

Abaxx plans on generating revenue in the following ways:

Exchange revenues sourced from futures trading commissions, clearing fees, and the collection of market data.

Licensing out ID++ applications and other software to third parties.

Royalties from spin-out companies.

All of these revenue sources generate high gross margins. For reference, ICE has approximately 55% gross margins, while CME has 85% gross margins. With minimal capex required to maintain a commodity exchange and launch new products… exchanges can be cash cows.

Given the high-quality nature of these businesses, they tend to garner high pricing multiples. Existing exchange operators have an average P/S ratio of ~10.

Abaxx Technologies retains an 88% ownership stake and a 2% royalty on gross revenues generated by the Abaxx Exchange. Abaxx Technologies has the right to make a payment of $10M to increase that royalty to 3% by December 14th, 2025.

The Abaxx Exchange has to generate positive earnings before income tax and depreciation of $25M in a calendar quarter before those royalties need to be paid out.

Additionally, Abaxx Exchange has an agreement with Abaxx Technologies to market and sub-license exchange and clearing software to third parties. Abaxx Technologies would receive:

20% of gross revenues up to US$2,000,000.

10% of gross revenues in excess of US$2,000,000 and up to US$5,000,000.

5% of gross revenues in excess of US$5,000,000.

Central to Abaxx’s business model, the exchange's cash will be utilized to fund the development of new futures contracts, software, and spin-out ventures.

Abaxx’s first spin-out company was Base Carbon (BCBN), created in 2021. Base is a carbon credit project financing company. Abaxx retains a 16% equity stake in Base and an indefinite 2.5% royalty on all gross revenues. Base has the option to buy back that royalty for $150M.

When Base went public via RTO, Abaxx paid out Base shares as a dividend to shareholders. For every fourteen (pre-reverse split) shares of ABXX, shareholders received one share of BCBN.

Moats

Besides the moats from regulatory/infrastructure hurdles or intellectual property via patents… the primary moat Abaxx will create is through network effects.

Futures contracts operate on liquidity; the more customers that trade a contract, the better. Without liquidity, bid-ask spreads widen, and it can be hard to enter or exit positions. In addition, widespread usage within a market is needed for price discovery.

Futures markets are similar to social networks in that they tend to be winner-takes-all environments. Once a commodity has 1-2 benchmark contracts, it’s very difficult for competitors to siphon away market share.

A benchmark futures contract tends to capture significant TAM, if not a majority, along with serving as a reference price for different commodity grades.

Miscellaneous Assets or Investments

LabMag and KeMag properties: Abaxx Technologies went public via an RTO with New Millennium Iron. These iron ore properties were transferred to Abaxx. At the peak of the last iron ore bull market in the early 2010s… the projects were worth nearly $1B. The company currently gives the properties zero value. At some point, they could be spun out into a new company or sold off. Abaxx also retains ownership of 15mt of port access at the Port of Sept-Îles.

SmarterMarkets podcast: Audio platform dedicated to outlining Abaxx’s vision of smarter financial markets.

Abaxx has directly received cold outreach market interest in new futures products from hosting this podcast.

VC Investments:

Privacy Code: SaaS platform for privacy management. As of December 31st, 2023, the investment is worth $137,000.

AirCarbon: Leading environmental markets exchange. As of December 31st, 2023, the investment is worth $161,000.

Smart Crowd: Dubai real estate crowdfunding platform. As of December 31st, 2023, the investment is worth $622,000.

Pasig & Hudson: Consulting, advisory, and development services in blockchain and other non-traditional banking solutions. As of December 31st, 2023, the investment is worth $1.5M.

Valuation

For the best direct comparison of what the Abaxx exchange might be worth, we can look at the sale of the Singapore Mercantile Exchange in 2013. Financial Technologies India sold the SMX to ICE for $150M. Adjusting for inflation, the exchange and clearinghouse sold for approximately $200M. That was for a less technologically advanced platform.

Before the recent 200% bull run in Abaxx’s stock, the value of the exchange’s technology alone presented a margin of safety for investors.

At this point, the valuation the stock might deserve depends on futures contract adoption over the next several years and beyond:

James Duade, a fellow investor in Abaxx, has already built out an in-depth DCF analysis estimating the value of the company’s futures contracts.

Assuming the company captures approximately 40-50% market share after 1-2 years in most of the markets they’re targeting and adjusting for recently disclosed trading commission figures, the value of Abaxx Technologies’ contracts would be worth $121 per share in 2025. This calculation was done with a P/S ratio of 9, representing an upside of 1,185% from today’s share price of $9.42.

DCF assumptions per contract:

LNG - $10 commission fee per trade. Market growth CAGR of 4.1% through 2030. 40% TAM captured by 2025, same captured by 2028. Profit margins at 45%. Discount rate at 10%.

Carbon - $1 commission fee per trade. Market growth CAGR of 17.5% through 2030. 25% TAM captured by 2025, 33% captured by 2028. Profit margins at 40%. Discount rate at 10%.

Nickel - $10 commission fee per trade. Market growth CAGR of 22% through 2030. 25% TAM captured by 2025, 50% captured by 2027. Profit margins at 40%. Discount rate at 10%.

Gold - $1.40 commission fee per trade. Market growth CAGR of 0.7% through 2030. 5% TAM captured by 2025, 10% captured by 2027. Profit margins at 40%. Discount rate at 10%.

Lithium - $4 commission fee per trade. Market growth CAGR of 13% through 2030. 20% TAM captured by 2025, 50% captured by 2028. Profit margins at 40%. Discount rate at 10%.

Strategic Investors

Abaxx recently conducted two separate raises to bring in institutional investors at both the exchange and parent company levels:

Abaxx Technologies: New investors include BlackRock, Wellington, Canoe Financial, and K2 & Associates.

Abaxx Exchange: New investors include CBOE, TLW Trading, and Traxys Lithium Investments.

Abaxx may raise another round at the exchange level to attract additional strategic investors that would help increase trading volumes.

When the company was ramping up developments earlier on, they raised funds from some interesting names as well:

Early angel investors included Robert Friedland, Lucas Lundin, Kyle Bass, and Erik Townsend.

Management Team

There’s no greater indicator of Abaxx’s potential success than the people running the company. This management team has been involved in launching ten different exchange and clearing platforms. A few stand-out executives:

Josh Crumb (Founder & CEO): Former director and commodities strategist at Goldman Sachs. Previously a director at the Lundin Group. Founded several companies in the gold space (Menē and Goldmoney).

Thom McMahon (Founder & Director): Founder of AirCarbon Exchange. Former chief executive officer at the Singapore Mercantile Exchange, licensed and launched the exchange/clearinghouse before it was bought out in 2013.

Joe Raia (CCO): Former global head of commodity futures at Goldman Sachs and global head of energy and metals futures at the CME/NYMEX. While at the NYMEX, he launched their ClearPort Clearing platform and created over 2000 different financial products during his tenure.

Dan McElduff (President): Former senior director at NYMEX Natural Gas and Clearport, as well as the chief regulatory officer at ELX Futures Exchange. Collaborated with Joe Raia at NYMEX.

Jeffrey Currie (Director): Former global head of commodities research and strategy at Goldman Sachs. Advised government agencies across North America and Eurasia.

As of December 31st, 2023, the insider ownership of directors and executives was approximately 13% of the outstanding shares in Abaxx. The team is experienced and has financial incentives to see the exchange succeed.

Share Structure

As of December 31st, 2023, Abaxx had approximately 31.4M shares outstanding. Add the 1.625M shares from the recent bought deal financing, and we’re currently sitting around 33M shares outstanding.

The company has around 540,000 options expiring throughout the rest of the year. Assuming they’re all exercised, the net proceeds would be around $4.4M.

Financial Status

So, how is Abaxx looking financially as the company closes in on exchange launch?

Given that Abaxx needs $18M to uphold compliance with RMO and ACH licensing regulatory thresholds, the company was close to running out of capital. Without more financing, the start of exchange trading looked shaky.

The company recently raised $12M. With an estimated burn rate of $4M per quarter, as mentioned in their last investor call, this gives Abaxx an additional three months of cash to fund operations through launch. They should have a cash position of around $31-32M. Expiring options could provide another quarter of runway.

Chances are, Abaxx will have to raise again in 3-4 quarters as ramping up open interest on an exchange isn’t a quick process. This is especially true when Abaxx is eyeing an increase in R&D spend on the tech side to further build out ID++. The hope is that the company will be at a higher valuation by the time it needs to come back to the market.

The estimated cash burn associated with technological R&D in 2024 seems to be around $4M USD:

The estimated cost to achieve commercial production for all applications is US$8 million. The net proceeds under the 2024 Bought Deal Offering are expected to fund approximately 40-50% of the necessary work to achieve commercial production. An additional amount of approximately US$4 million of expenditures is anticipated to be required to reach full commercial production across the five apps, with a projected development timeline of 12 to 18 months.

Assuming the burn rate of $4M per quarter is upheld, here is what’s required for Abaxx to reach breakeven:

With an average of 21 trading days a month and $10 in commission fees per contract ($5 for buyer, $5 for seller), Abaxx would need an average daily volume (ADV) of approximately 6,500 contracts to reach quarterly breakeven. That’s based on fee pricing for LNG and nickel; carbon pricing fees are only at $1 per contract currently. 6,500 contracts would get us to around $4M in revenues.

Risks

With regulatory hurdles out of the way, Abaxx's primary risk at this point would be if its futures contracts failed to garner broad market adoption. Growth projections are dependent on these products becoming benchmarks in their respective industries.

Even if these contracts do become benchmarks, it could take longer than projected. Building new markets can be a slow process as Abaxx is coordinating initial block trades.

While I would assume incumbents are more likely to try to buy out Abaxx rather than competing with them directly… competition is a potential risk. Ultimately, if they wanted to, entrenched players like CME or ICE could move to develop their own contracts or technology similar to Abaxx.

Abaxx has delayed exchange launches several times now. They originally projected they’d launch in 2021, which sounds funny now. Further delays in finalizing the first trades is possible.

Further share dilution is feasible, as Abaxx is still unprofitable and in the process of launching its financial products. Additional expenditures related to developing ID++ could contribute to increased cash burn.

Upcoming Catalysts

Uplisting to a higher-tier exchange. Previous efforts to uplist on the CBOE US were put on the back burner while working on launching the exchange. It’s unclear if Abaxx still wants to uplist on the CBOE or has shifted back to thinking about uplisting on the NASDAQ.

Announcement of the completion of the first block trades using Abaxx futures contracts. The names of the firms involved could attract larger investor interest.

Abaxx is entering the revenue growth phase of its business. It could reach financial breakeven within the next year.

News on lithium or precious metals contract developments, as well as new potential contracts in their pipeline.

Disclaimer: I’m long Abaxx Technologies. I hold an equity position that was acquired at an average share price of $5.51. I was not compensated by the company to create this post.

The owner of Green Investing is not a licensed investment professional. Nothing produced under the Green Investing brand should be construed as investment advice. My content is made for entertainment and educational purposes. Do your own research.

Based on the first graphic in the report - the one from James Duade - Abaxx Technologies is a subsidiary of Abaxx Hold Co. But this one isn't listed... or did I miss something?!

Well done 👍

Even after the latest rise in the share price, the potential is very close to "ridiculous high" and very hard to evaluate. I cost average up my position.