Abaxx Technologies (ABXX) - Launch Time

We have confirmation the exchange is launching June 28th.

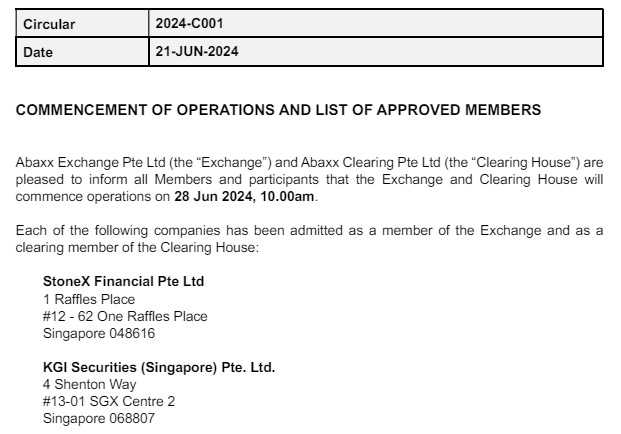

In several circulars released today on the Abaxx Exchange’s website, the company revealed that its exchange will officially launch on June 28th, 2024.

As you can see, StoneX and KGI Securities will be the first two futures commission merchants (FCMs), aka clearing members, once operations begin.

This means Abaxx is likely launching without Mizuho (the assumed holdout FCM that Abaxx has been waiting on for months) unless they’re operating as a carry broker and not an FCM.

The status of Mizuho is unknown, but I assume they’ll be onboarded relatively soon. There’s nothing stopping new FCMs from being brought in shortly after operations have started.

As far as other members, we know that Marex Group and ABN AMRO are also carry brokers for the exchange, providing supplemental services through one of the existing FCMs.

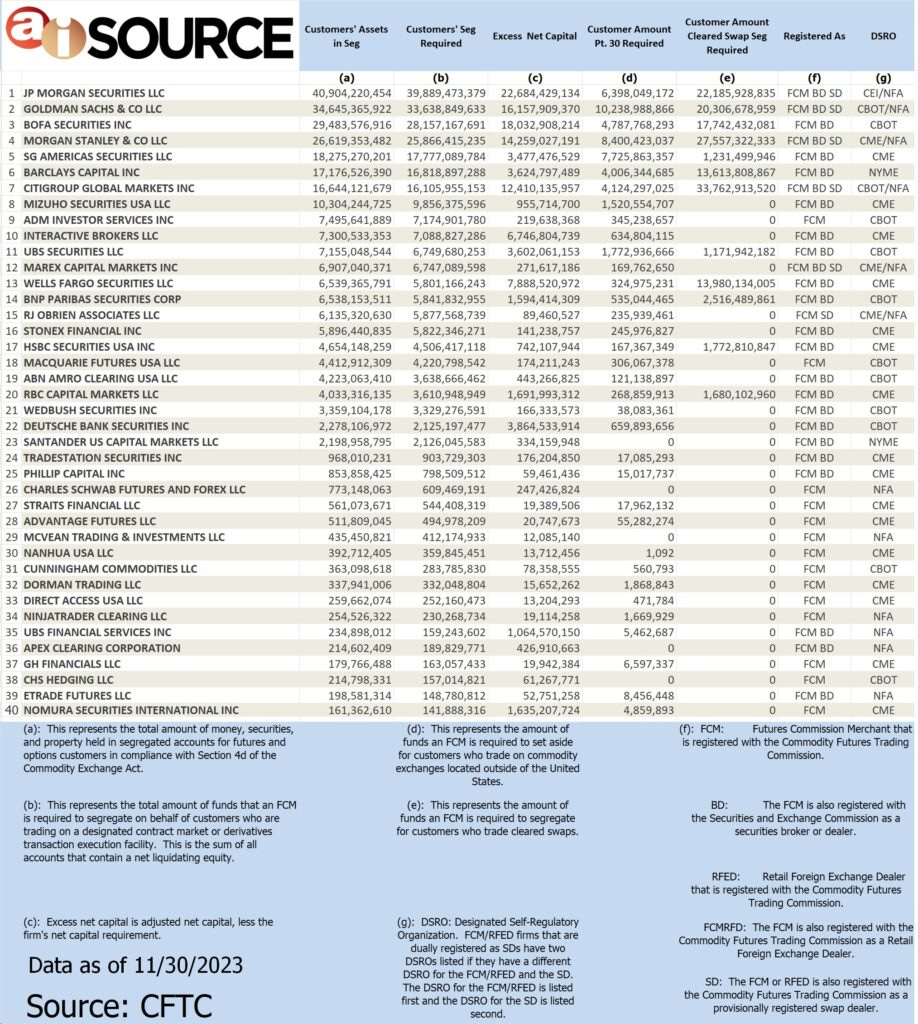

Abaxx has already started to attract some of the large FCMs. As of 2023, Mizuho was ranked #8, Marex was ranked #12, StoneX was ranked #16, and ABN AMRO was ranked #19.

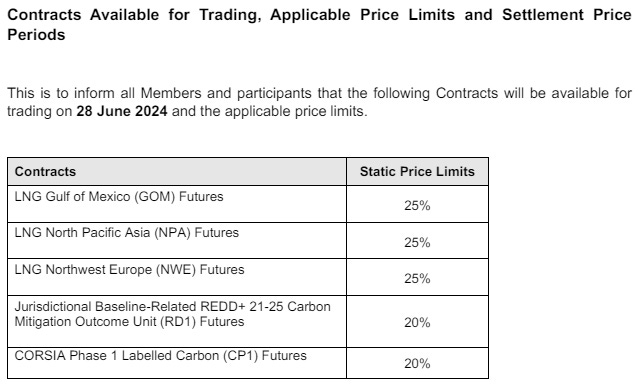

Something else to note is that the nickel futures contracts aren’t immediately listed in these circulars, so earlier disruptions from the Francis Scott Key Bridge collapse in Baltimore might’ve been enough to temporarily suspend trading for that contract.

Either way, it’s exciting to finally see the exchange launch.

Abaxx will be hosting an investor call on July 3rd to provide updates on how things are progressing. I’ll hopefully be able to take notes on the call and upload them on Substack shortly after.

Disclaimer: I’m long Abaxx Technologies. I hold an equity position that was acquired at an average share price of $5.51. I was not compensated by the company to create this post.

The owner of Green Investing is not a licensed investment professional. Nothing produced under the Green Investing brand should be construed as investment advice. My content is made for entertainment and educational purposes. Do your own research.

Great, quick hit writeup! Thanks for sharing your thoughts on this recent event for Abaxx.

Any thoughts on whether you can get enough liquidity for the LNG contract through the confirmed FCMs? And how big of a game changer would Mizuho be?