Aduro Clean Technologies (ACT) - Revolutionary Recycling Technology

The potential answer to the plastic recycling problem.

See updates and investor call notes in the Aduro Clean Technologies tag.

Note: All monetary figures are denominated in USD.

Highlights

Aduro is a potential beneficiary of governmental/industry tailwinds and a growing realization that plastic recycling is uneconomic in its current form.

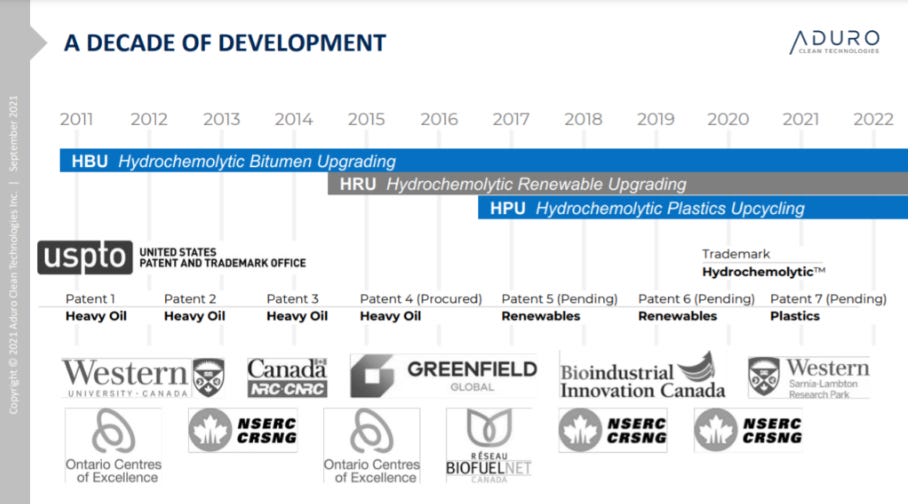

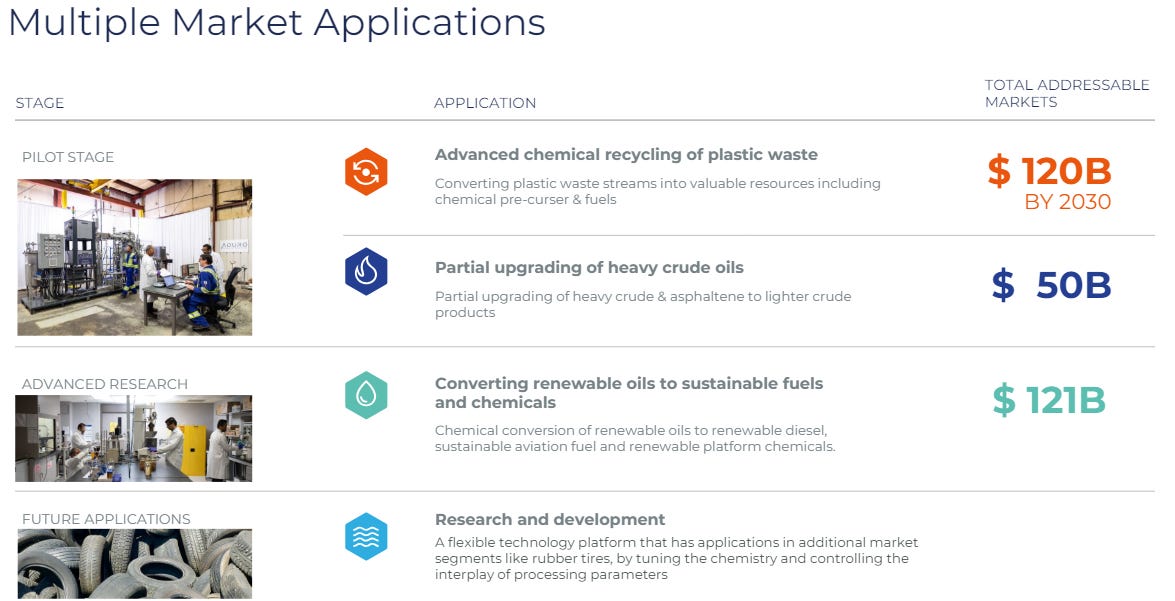

The company has spent over a decade developing a new, revolutionary recycling process that works on not just plastic, but also bitumen, renewable oils, and other market verticals as well. In aggregate, the TAM of these industries exceeds $200B.

Shell SHEL 0.00%↑ and five other multi-billion valuation companies (unnamed due to NDA) are testing Aduro’s technology through a customer engagement program.

Aduro’s business model focuses on capex-light licensing agreements to hasten the commercialization of its technology.

They aim to conclude the pre-commercialization phase of their development by completing a pilot unit that can recycle 5-10 tons of plastic waste per day by H1 2025.

If Aduro were to recycle 1M tons of plastic waste per year, which was Shell’s 2025 recycling goal, the company would generate $106M in EBITDA thanks to licensing revenues. A modest 10x EBITDA multiple would value Aduro at over $1B (in 2027-2028).

Stock Information

Name: Aduro Clean Technologies

Market Cap: $68M

HQ Location: London, Ontario, Canada

Tickers: ACTHF on the OTC, ACT on the CSE.

The Plastic Problem

Depending on which source you’re looking at, the world currently produces between 350M and 450M tons of plastic waste per year.

According to the United Nations, that number is estimated to triple if we don’t take action to quell this growing concern.

This waste is either being dumped in developing countries, offloading the burden onto the third world… or filling up our landfills and oceans. The world is running out of places to store our trash, and it’s entering larger ecosystems.

We’re learning more and more about microplastics… and the results aren’t pretty. Research from animal studies has concluded that ingesting microplastics appears to reduce fertility and increase the risk of various cancers.

The worst part is that it’s practically impossible to avoid them at this point. They’re small enough to be found in our oceans, dust, rainwater, seafood, produce, and more.

The video above is from The Ocean Cleanup, an organization that’s leading the charge in combating plastic waste in our oceans.

Even if non-profits like this are starting to clean up some of this waste…

The world produces more waste than they could ever hope to collect; they’re just slowing the spread down a bit.

We don’t have any technologies capable of recycling all of this junk. Less than 10% of the plastic waste we produce is recycled per year.

Consumer behavior isn’t going to change. Plastic is used in so many products that limiting its spread is a tall task.

Products like food containers, bags, bottles, clothing, beauty products, and cooking materials all contain plastic. The list is extensive.

Good luck convincing the average citizen to give up these items, or use a less efficient paper version when possible. We need new solutions.

Corporate And Government Efforts

Both corporations and governments around the world are waking up to this problem. The winds are clearly blowing in the direction of outrage over what’s happening to our planet. Large producers of plastic are seeing this, and want to get ahead of the eventual punishment they might face.

The most significant current global effort is the potential for creating a UN global plastics treaty. This would perform similarly to the Paris Agreement on limiting carbon emissions but for plastic waste. Over 170 countries are involved in collaborations.

While progress is being made, we’re witnessing sharp disagreements over what actions to take to limit plastic’s negative effects. More than fifty countries are advocating for targets on reducing plastic production. Obviously, the plastics industry is not a fan of this proposition. Negotiations are ongoing, with another meeting (INC-5) expected to take place in Korea from November 25th to December 1st.

The final terms of the agreement are expected to be outlined by the end of 2024, but we all know how these negotiations go. It could take some time to see something concrete.

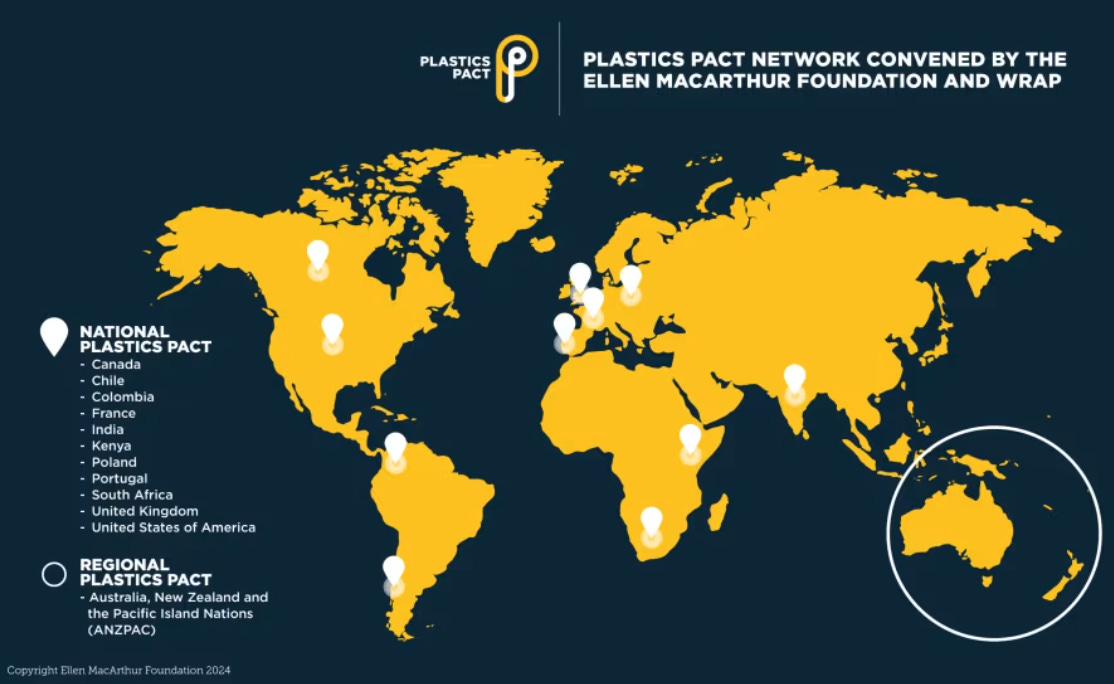

While the world is still working on developing a global treaty, there are a variety of regional treaties on changing the production process of plastic.

These pacts are focused on implementing the necessary foundations for creating a circular economy, where all of this plastic waste can be reused and recycled. The best part, many of them have 2025 deadlines and goals. This creates an incentive to find new solutions, and find them fast…

Major plastics pacts include:

A variety of treaties across major countries in Europe.

The ANZPAC Plastics Pact (Australia, New Zealand, and the Pacific Islands)

The Canadian and US plastics pacts require members to take tangible measures to recycle or compost 50% of their plastic packaging by 2025. This is an ambitious goal, given that less than 10% of plastic waste can be recycled currently.

Some members of those pacts include Unilever, Keurig Dr. Pepper, General Mills, Coca-Cola, Walmart, Target, Danone, McDonald's, Colgate-Palmolive, and many more. Plenty of well-known brands and companies.

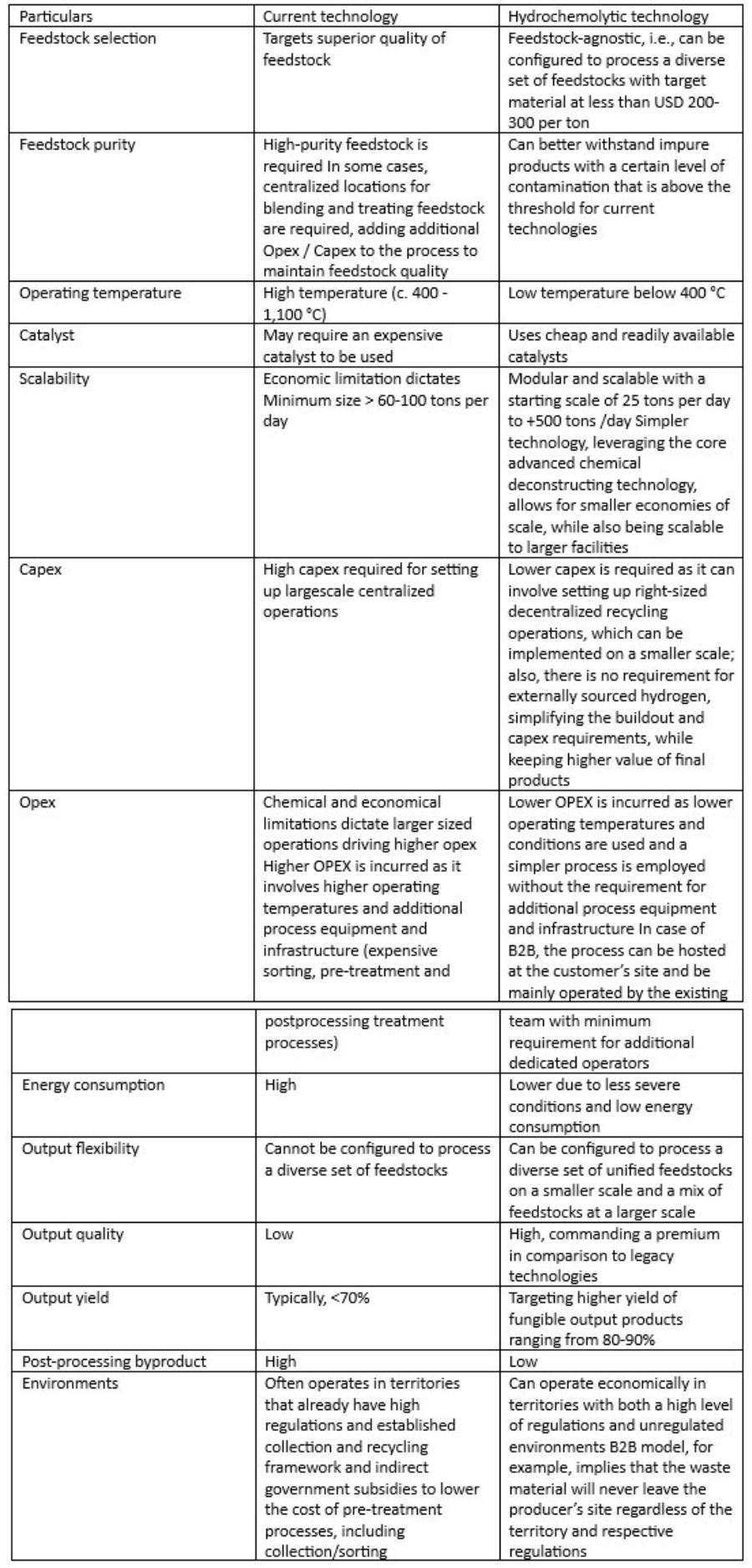

An issue that many of these companies have discovered, is that existing technologies are uneconomic in most scenarios. Often reliant on subsidies, or sourcing the highest-quality feedstock they can.

Government efforts like the Inflation Reduction Act or a 2023 US EPA initiative to provide $100M in grant funding for recycling programs can provide some incentives to increase plastic recycling. With that said, these tax credits or subsidies aren’t going to improve the underlying technology.

Existing Recycling Methods

Mechanical recycling: Reprocessing and modifying existing plastic waste without any modification of the underlying plastic polymers. This process includes collecting, sorting, grinding, washing, drying, re-granulating, and compounding the plastic feedstock. Over time, the quality of this plastic degrades as the cycle is repeated multiple times.

Energy recycling: Incineration of plastic waste in specialized boilers or industrial furnaces. This controlled combustion process releases stored energy as heat, which can be used for electricity generation or industrial processes. Expenses add up quickly with the significant investment required to build these facilities, with environmental concerns over waste emissions.

Chemical recycling: The chemical breakdown of plastic polymers at a molecular level to create new materials. These processes require catalysts to create chemical reactions. The three main types are:

Pyrolysis: Usage of extreme heat temperatures to break down the plastic waste in an oxygen-free environment. The output is often liquid oil that can be fed back into an industrial steam cracker used to create more plastic. Drawbacks to this process include limited yields, high feedstock sorting requirements, and possible carbon emissions.

Gasification: Plastic polymers are treated at high temperatures in an oxygen-rich environment to convert the plastics back into their basic components of hydrogen and carbon monoxide. These products can be used to create methanol, or back into plastic polymers once again. Downsides include significant capex to convert these gases back into liquids and the possible carbon emissions.

Solvolysis: Introduction of a solvent to break down plastic waste. In addition, a catalyst is required to incite a chemical reaction, possible catalysts include water, alcohol, acids, and bases. Again, this process requires high levels of energy and potentially hazardous solvents.

Common Issues For These Technologies

Extensive pre-sorting of the waste.

The cost of using extreme levels of heat.

Only working on one particular type of plastic.

Plastic waste feedstock has to be high-quality with low levels of contamination, which leads to increasing competition for cleaner waste.

A necessity to build several additional facilities to handle post-treatment hydrogenation of the yielded material. Beyond the first recycling facility, many processes need another plant to handle post-treatment, and a third to generate the required hydrogen.

If the end product isn’t already highly saturated (too many contaminants), then hydrogen needs to be introduced to create another chemical reaction.

In many cases, these existing technologies are uneconomic, especially without subsidies. This explains why less than 10% of plastic waste is recycled annually.

Aduro Clean Technologies

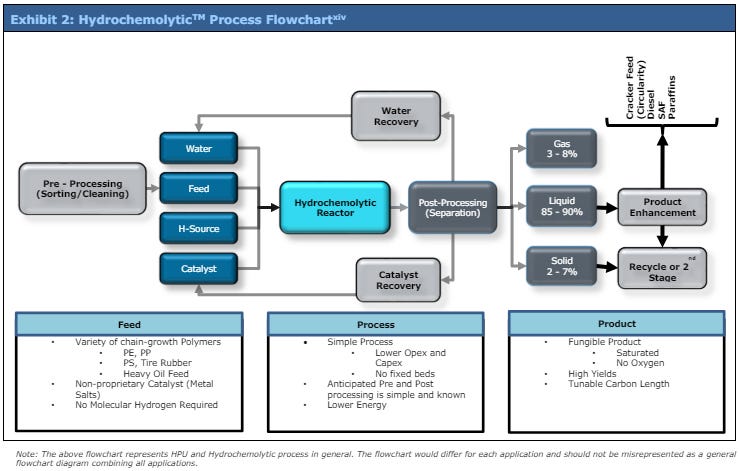

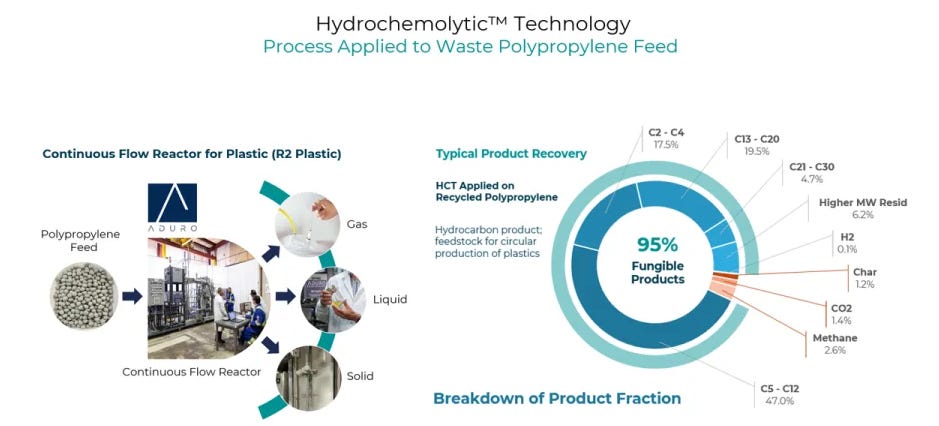

Aduro Clean Technologies is developing a new type of chemical recycling called Chemolysis. The company’s application of the technique uses water, so they commonly refer to their process as a Hydrochemolytic (HTC) technology. Here is a great description of how the technique works from Arrowhead:

The process commences with the introduction of post-consumer plastics, waste rubber, renewable oils or heavy bitumen into a set of reactors, each with varying severity levels from low to high – depending on the complexity of the feedstock. The process breaks down the larger molecules to increase the output yield.

Water, an integral part of the process, is used as a medium for chemical reactions. It is also used for transferring heat, transporting the coagents and maintaining suspension of the liquid intermediates and coagents/catalysts in the reactor. The amount of water used in HCT is significantly less than competing technologies such as hydrothermal technologies, and the water is recycled and reused in the process.

Aduro uses cheap, bio-based material sources such as biomass, to create hydrogen equivalents which improve the product quality. Note that the HCT does not use molecular hydrogen – the production of molecular hydrogen has negative environmental impact and requires complex infrastructure and capex. For hydrogen equivalents, the company initially started with glycerol and has since developed many other sources of hydrogen equivalents, such as cellulose, ethanol and methanol. In the case of mixed waste plastics, the company can use elements existing in the waste feedstock and considered as contaminants as H-source, byproduct of waste polyethylene for example. The technology can use various bio-based materials, which is a testament to its operational flexibility to adjust to varying customer needs, feedstock composition and market conditions.

Another key step is the addition of readily available low-value catalysts that are fed into the reactor to reach the necessary concentration level. The HCT platform uses readily available and inexpensive catalysts (listed in the last bullet point) to run its chemistry, catalysts are readily available in the feedstock itself and/or added as needed.

Water carrying the hydrogen equivalent, and the catalyst enters the reactor and is mixed with the liquid intermediates.

The upgrading reaction results in the simultaneous deconstruction of molecules followed by saturation of the broken chains, thereby significantly simplifying the process.

The liquid product from the reactor is sent to a separator where the water and gas are separated from the final output.

Due to the low severity condition, including operating below cracking temperature, the amount of gas produced in the reactor is relatively low, which is pivotal to driving higher liquid yield and a lower environmental footprint. Also, a significant amount of the generated gas (estimated at 60%) can be used as fuel to help offset the cost of purchased energy for the process, making the technology a gold standard for its CO2 footprint.

The liquid output is almost fully saturated (approximately 95% saturation) and, therefore, does not require any further hydrogenation. It can be sold as input oil for industries such as refineries or to produce new plastic.

Possible oil end-products of Aduro’s process:

Diesel

Kerosene

Lubricating oil

Heavy fuel oil (bunker fuel)

Naphtha (used to create more plastic)

Advantages of Aduro’s Technology

To summarize, Aduro’s technology:

Operates at lower temperatures.

Recycles waste feedstock at higher yields.

More readily handles existing contaminants in the waste feedstock.

Uses cheap and readily available catalysts, oftentimes found in the waste itself.

Can be used to recycle polyethylene (PE), polypropylene (PP), and polystyrene (PS). Not just one type of plastic.

Economically viable at a smaller scale of just 25 tons recycled per day. Modular by nature, so more reactors can be added on as needed.

Doesn’t require costly hydrogenation in post-treatment, which means Aduro only needs their recycling reactors; they don’t need to build several facilities. This significantly reduces the capex and opex required.

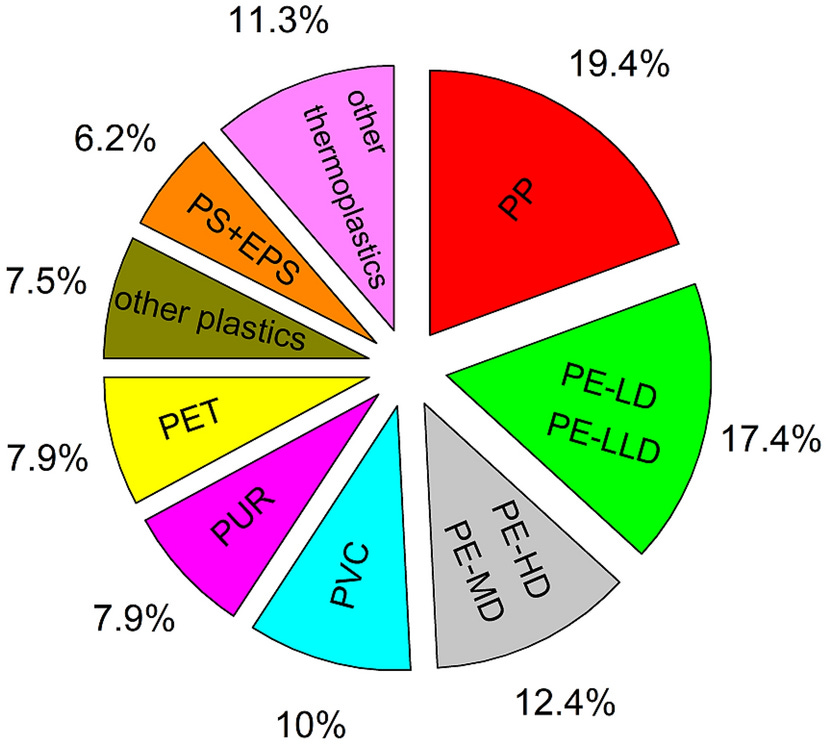

Types of Plastic

Legend:

PP - Polypropylene (tupperware, car parts, yogurt containers)

PE - Polyethylene (grocery bags, milk jugs, plastic wraps)

PVC - Polyvinyl chloride (building and construction materials, pipes)

PUR - Polyurethane (coatings, foams)

PET - Polyethylene terephthalate (drink and food packaging, bottles)

PS + EPS - Polystyrene + expanded polystyrene (styrofoam)

Given that Aduro can recycle polyethylene, polypropylene, and polystyrene, they can address at least 55% of the plastic being produced globally.

Announced Yield Results

Continuous flow reactor testing, involving over 240 test runs on polypropylene (PP) plastic waste, yielded an average of 95% usable product.

Testing of recycling more complex crosslinked polymers (XLPE) led to yields of up to 84% usable product. This plastic is found in building materials and car tires. These results led to the possibility of exploring another market vertical: car tires.

Public Plastic Recycling Competitors

PureCycle Technologies (PCT): The current market cap of $850M. It uses a solvolysis process that only works on polypropylene waste. Their technology is licensed from Procter & Gamble… PureCycle doesn’t own it. They have one operational commercial facility that has undergone various issues.

Agilyx (AGXXF): The current market cap is $250M. It uses a pyrolysis process that recycles polystyrene and PMMA plastic waste. Agilyx claims their joint venture pilot facility was a “success,” while operating at a loss and lower than production expectations. Commissioning of their first commercial center is expected to be completed by Q1 2025.

Loop Industries (LOOP): The current market cap is $115M. Their solvolysis process only works on PET plastic waste. They have an operational pilot plant. The only timeline I could find for commercialization was for a facility in India, expected to be completed by the end of 2026. Another construction project in South Korea is estimated to “break ground” in 2024, which means nothing. They’ve been saying they would start construction for two years now.

Pryme N.V. (PRYME): The current market cap is $47M. Similar pyrolysis process but slightly tweaked. Works on polypropylene and polyethylene plastic waste. Produced oils from their first production facility in Q1 2024.

PlasCred Circular Innovations (PLAS): The current market cap is $5M. Yet again, another version of pyrolysis. Works on polypropylene and polyethylene plastic waste. Their pilot facility was built in May 2023.

As you can see, several competitors sit as significantly higher market caps while not being particularly far ahead of Aduro in the commercialization process. All of them are using some modification of existing recycling processes… that often fail to reach economic viability.

Poor investor experiences with recycling companies like Cielo Waste Solutions (total flop), PureCycle Technologies, and Loop Industries have made them wary of new entrants. This, in part, explains the “wait and see” approach of many investors who want confirmation that Aduro can deliver on its promises before investing.

Market Size and Different Verticals

For the sake of brevity, this write-up is focused on the use case for Aduro’s technology in the plastics industry, but the company could explore several other potential market verticals with similar characteristics in the future.

Fun fact: Of the potential market verticals that Aduro is researching, plastic recycling was actually the last one to begin testing.

The company originally started out by testing its technology on the possible use case for upgrading heavy oils into lighter fuels. In particular, bitumen (asphalt) upgrading, which is currently difficult to transport and process.

Market verticals in advanced development:

Plastic recycling (HPU): The hydrochemolytic plastics upgrading unit transforms waste plastic into high-value fuels.

Bitumen upgrading (HBU): The hydrochemolytic bitumen upgrading unit transforms heavy oils into lighter fuels to avoid costly processing and eliminate the need for diluent blending for pipeline transportation.

Renewable oil upcycling (HRU): The hydrochemolytic renewable upgrading unit takes seed or other renewable oil sources and converts them into high-value fuels.

Combined, the potential TAM found in recycling plastic waste, bitumen (asphalt), and renewable oils (seed oils) totals up to over $200B by 2030.

Other potential market verticals:

Car tire (rubber and cross-linked polymer) recycling

Foam recycling

Testing Process

Aduro separated its testing efforts into three phases:

R1 - Lab testing in a batch process.

R2 - Running waste through a continuous flow recycling reactor process, recycling several kilograms of plastic waste per hour.

R3 - A pre-commercial continuous flow unit that can recycle approximately 5-10 tons of waste per day.

These units will showcase the technology’s capabilities and process waste products for potential customers. The company currently has ongoing testing with R2 pilot units for both plastic and bitumen recycling. They’re working on designing an R3 unit for plastic, targeting completion by H1 2025. Data from R1 and R2 testing will inform the company about how to design the R3 system.

Patents (7 Granted - 1 Pending)

Method for Extracting and Upgrading of Heavy and Semi-Heavy Oils and Bitumen (Grant number: 7947165)

This patent was transferred to Aduro.

Method for Extracting and Upgrading Heavy and Semi-Heavy Oils and Bitumen (Grant number: 8372347)

This patent was transferred to Aduro.

System and Method for Controlling and Optimizing the Hydrothermal Upgrading of Heavy Crude Oil and Bitumen (Grant number: 9783742)

System and Method for Controlling and Optimizing the Hydrothermal Upgrading of Heavy Crude Oil and Bitumen (Grant number: 9644455)

System and Method of Controlling and Optimizing the Hydrothermal Upgrading of Heavy Crude and Bitumen (Grant number: 10323492)

System and Method for Hydrothermal Upgrading of Fatty Acid Feedstock (Grant number: 10900327)

System and Method for Producing Hydrothermal Renewable Diesel and Saturated Fatty Acids (Grant number: 11414606)

Pending - Chemolytic Upgrading of Low-Value Macromolecule Feedstocks to Higher-Value Fuels and Chemicals (Application number: 17494360)

Signs The Technology Works

All of the various advantages found in Aduro’s technology almost sound too good to be true… how can we know if this technology works?

Unless you’re a chemist by profession, it’s hard to claim you can fully understand if their process works on a deep level. At the very least, it would take months of research… if not years.

I will be the first to admit that my only experience in this realm is from a high school chemistry class— in which I got a C.

So, how can I be confident that this technology is legitimate if the company hasn’t built any commercial units yet?

Extensive signs of third-party validation:

After reviewing Aduro’s technology for a year, Brightlands Chemelot, one of the largest technical research institutes in Europe, announced a partnership with Aduro to set up a pilot unit on its grounds to demonstrate the technology.

Once an R2 pilot unit was built for bitumen, the technology received third-party validation from Professor Dr. Paul Charpentier at Western University in January 2022. He is a professor in Western University’s Department of Chemical and Biochemical Engineering and Mechanical and Material Sciences. Dr. Charpentier holds a Master of Science degree in Polymer Chemistry from the University of Waterloo and a PhD degree in Chemical Engineering from McMaster University.

Aduro was accepted into the Shell Gamechanger program in November 2022. This six-stage process involves rigorous testing of startup technologies, non-dilutive funding, and technical expertise from Shell engineers as the company progresses toward commercialization.

In Aduro’s 2023 year-end investor call, management confirmed that the company was finalizing stage 4 and beginning work on stage 5. Making it that far in the process is a good sign, and news on its completion should be coming in the next few months. The company has completed each stage at a pace of around 3 months, which would put finalization in June-July. At that point though, there could be negotiations with Shell that prolong timelines.

Eric Appelman, Aduro’s Chief Revenue Officer, joined the company in September 2023. He has maintained a 30+ year career in the petrochemical industry, working at companies like Unilever and Perstorp. Before taking this role at Aduro, he was also the Chief Technology Officer at Brightlands Chemelot. During his tenure there, he tested and oversaw 70+ different start-up technologies on the campus. Ultimately, he was so convinced by Aduro’s results, that he decided to join them. That is a major vote of confidence from an industry veteran.

On May 9th, 2024, The Canadian Trade Commission Service organized a delegation of key figures in government, institutional bodies, regional authorities, and companies active in sustainability, hydrogen, and circular economy solutions. As part of the program, the delegation will attend company presentations from a select group and tour the facilities of the Brightlands Chemelot Industrial Park. Out of 130 companies on the Brightlands campus… Aduro was one of the four companies that were selected to present to this delegation. The press release came out recently after negotiations for the global plastics treaty in Canada.

Aduro has ongoing testing with six multi-billion valuation companies, one of those being Shell. The five other firms have opted to sign NDAs so Aduro cannot disclose their names.

One of those companies opted to expand its ongoing testing with additional funding, a funding increase of 450%. With that said, the amount allocated isn’t particularly large… but throwing more money at Aduro indicates that they liked the results they were getting. That’s another positive sign.

Partnerships

Shell Gamechanger: As of November 2022, Shell has been helping Aduro commercialize its technology through a six-stage program that provides non-dilutive funding and technical expertise. Once the program is concluded, there’s potential for further negotiations and partnership opportunities. Ultimately, the end result is unknown.

Brightlands Chemelot: In 2023, Aduro partnered with Chemelot Innovation and Learning Labs (CHILL) for an experimentation program on the Brightlands campus. In exchange for financial support, Aduro receives access to skilled researchers, specialized equipment for data testing and analysis, and additional services, including access to CHILL partner events and public relations campaigns.

Western University: In early 2023, Aduro launched a three-year project with Western University to advance the company’s research and provide opportunities to train and mentor university researchers. The university is one of the main places where Aduro recruits new talent.

Prospera Energy (PEI): In August 2023, Aduro and Prospera opted to advance an agreement for a three-phase engagement that would evaluate and develop a bitumen upgrading pilot plant. Considering phase one was expected to reach completion by December 2023… with no news on this since— I assume this project has been put on the back burner.

Phase one involves a combined working plan of laboratory and continuous flow work using Prospera bitumen and Aduro’s HCT process.

Phase two includes preliminary engineering, identification of the pilot plant site, and reviewing of licenses and permits, as well as detailed budgeting and agreement to proceed with construction.

Phase three includes the procurement, fabrication, construction, commissioning, and operation of a 50 barrel per day pilot plant.

Aduro has partnered with engineering firms Exergy Solutions, Switch Energy, and Rally Engineering on various projects. These companies have built similar systems before, so Aduro isn’t all that worried about scaling their process to commercially viable levels.

Mena Beshay, Aduro’s CFO, points out that the physical systems Aduro is using aren’t particularly unique. The chemical process itself sets its system apart from its competitors (timestamp - 1:23m)

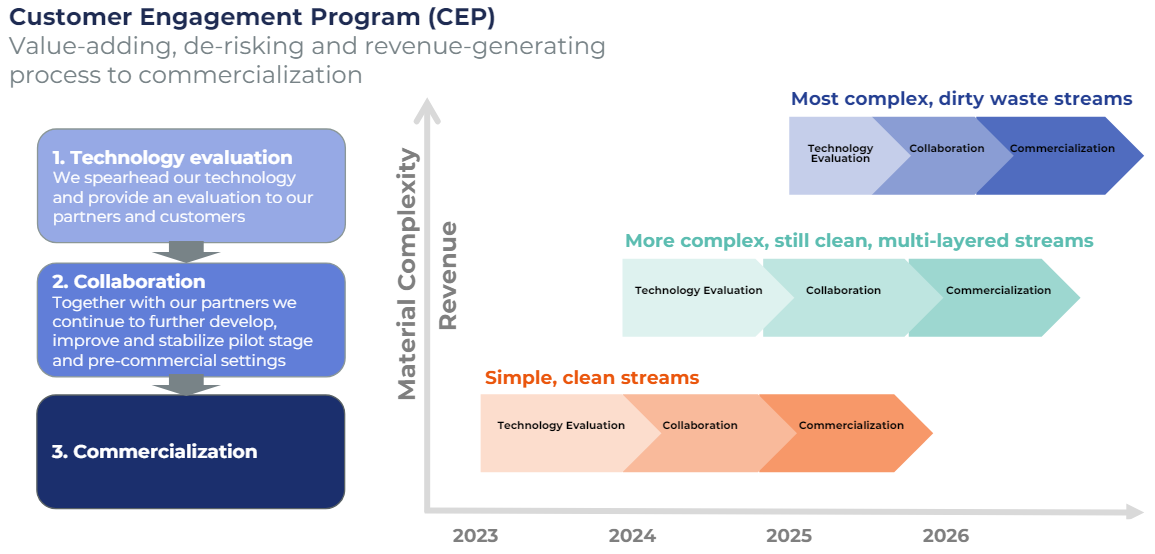

Customer Engagement Program

Testing with potential commercial customers is done in what Aduro has coined the Customer Engagement Program (CEP).

The program is separated into three phases: technology evaluation, collaboration, and commercialization. Aduro’s focus is on testing and commercialization of facilities focused on simpler waste feedstocks first. Customers with more complex or dirty plastic waste will largely enter the program later on.

Including Shell, there are six different multi-billion valuation companies testing Aduro’s technology:

3 plastic producers

1 plastic converter

1 food packing company

1 building materials company

All of these companies are still in the technology evaluation stage of the CEP.

In Aduro’s 2023 year-end investor call, management also confirmed they had over 20 active dossiers, companies looking into Aduro’s process and considering entering the program.

Given that the company only has one R2 unit for bitumen, and one R2 unit for plastic, they can only conduct testing for so many firms at one time.

These testing efforts generate revenues for Aduro. The amount varies by stage and time frame. For reference, Prospera Energy (another partner, not a multi-billion company) was set to pay $18,000/month for phase one of their testing initiative.

These revenues are in the low hundreds of thousands currently but could become increasingly significant with the signing of collaboration agreements. In addition, the typical time frame given for the technology evaluation phase of the CEP was approximately 3-6 months, but timelines can vary.

Business Model

After customers are satisfied with the results they’re getting with Aduro, the companies move on to the commercialization process.

In most cases, Aduro has opted for a capex-light licensing model. They’ll likely create a few of their own plants, but most facilities will ultimately get built by other organizations.

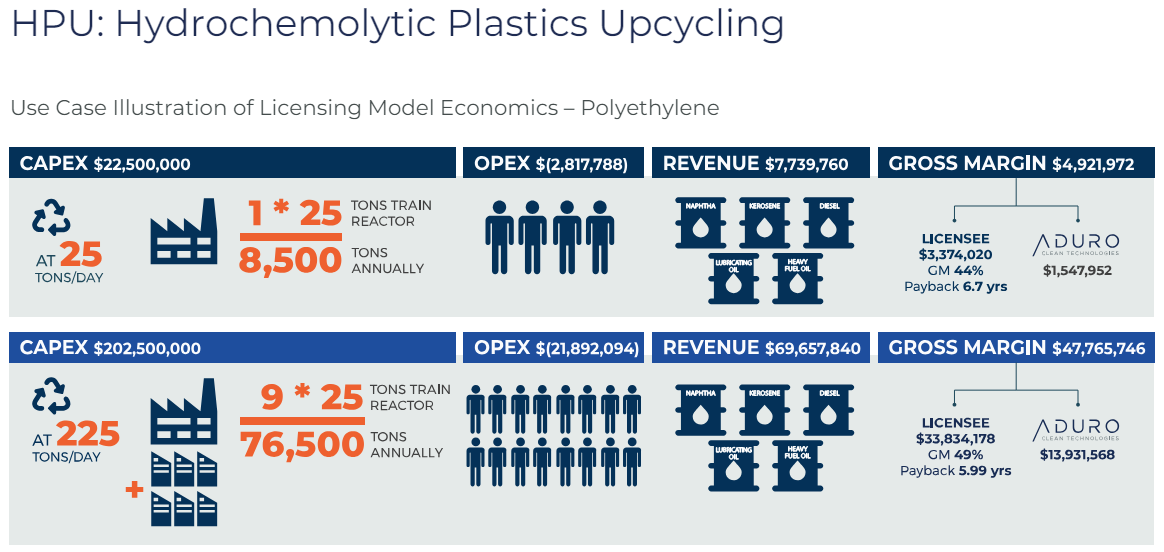

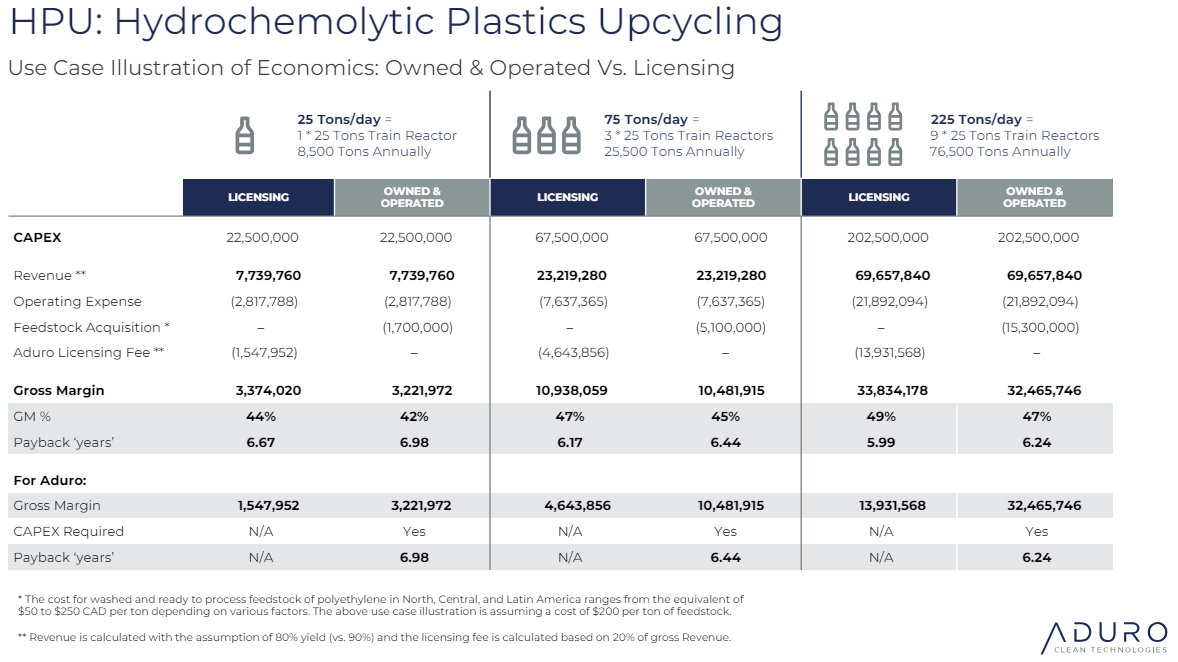

Aduro will license the technology to other companies, and in return, those companies will construct/operate the recycling units themselves and pay licensing fees to Aduro. This leads to minimal capital outlays and high margins for Aduro while earning approximately 20-30% of the revenue generated by these plants.

The economics are still favorable for the few plants that Aduro might build independently, with projected 40-50% gross margins:

The R3 pilot reactor, set to be built in H1 2025, will recycle 5-10 tons of plastic waste per day. Depending on the type of waste being recycled, the resulting oils can be sold for between $600-$1500/ton. This means that Aduro could generate $1M-$5.5M in 2025 from this unit if the recycling reactor is operational year-round. If Aduro is being paid to take the plastic waste, then the revenues could be even higher.

Valuation Scenario

Shell previously announced an ambitious plan to recycle 1M tons of plastic waste by 2025. The company wanted to recycle as much plastic as it produces annually.

Unfortunately, in 2023, Shell revealed that this goal was unattainable given slow technological development and a lack of quality feedstock.

Aduro won’t be able to recycle 1M tons by 2025… but what would the numbers look like if they were able to hit that goal later on? We’re dealing with 450M tons of new plastic waste per year, hardly any of it is being dealt with right now— so this number isn’t at all unrealistic if Aduro manages to scale its technology efficiently.

If we take their revenue expectations for a facility recycling 76,500 tons annually and extrapolate those numbers to account for recycling 1M tons (13x)… Aduro would receive approximately $133M in royalty fees.

Given this business model's capex-light nature, the company's financial projections expect around 80% EBITDA margins. That would put us at ~$106M of EBITDA. A modest 10x multiple would put Aduro at over a $1B valuation in this scenario. It’s not difficult to imagine how this company could reach a multi-billion valuation when they scale through licensing. This doesn’t even include other market verticals. Just plastic.

Potential Margin of Safety

In July 2022, Ofer Vicus, the CEO of Aduro, mentioned in an interview with Mariusz Skonieczny that the company’s technology would probably be valued at over $100M if they tried to sell their patents (timestamp - 35:43).

In the case of a firesale or bankruptcy scenario where they had to sell, then he still thought the technology would be worth $25M-$50M. Theoretically, this provides a decent margin of safety while the stock sits at a market cap of $68M.

Now, this was before they had even joined Shell Gamechanger, and achieved a variety of other positive milestones. If asked again, Ofer might provide a much higher estimation. At the same time, how much you value this is also based on how much you trust management’s word. Ultimately, that’s a choice for you to make.

Ultimately, the intellectual property and patents are this company’s moat. If this process can scale, then there isn’t any other firm in the recycling space that can do what Aduro can.

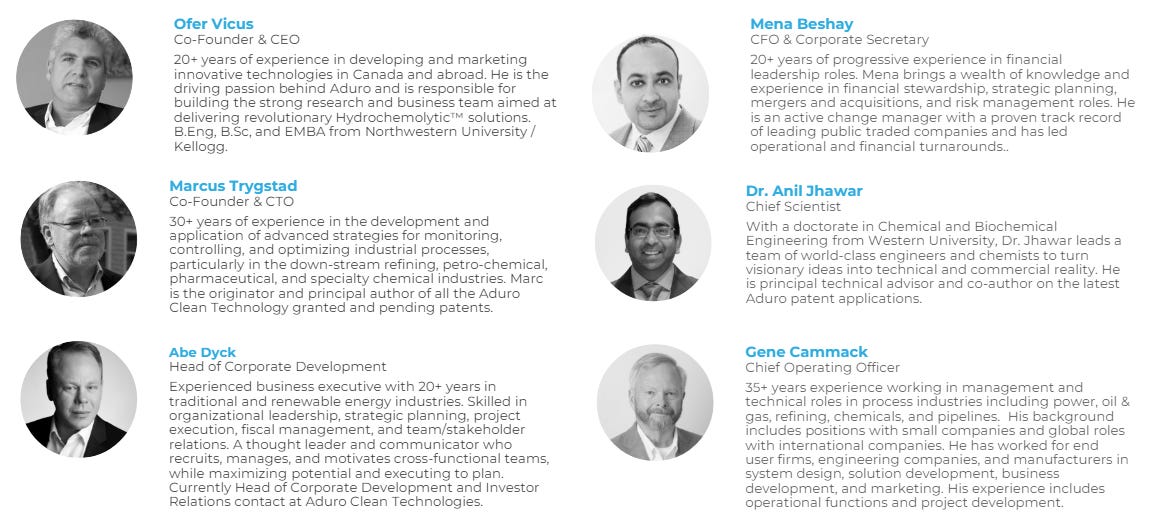

Management Team

Aduro’s management team has degrees and backgrounds in the petrochemical industry, engineering, and chemical/biochemical science. The company has been scaling its technology for over a decade now (since 2011).

Executives not pictured:

Eric Appelman, CRO: Previously CTO at Brightlands Chemelot, CTO at Perstorp, non-executive director at Earth Energy Renewables, MSc in Chemical Engineering.

Birendra Adhikari, Head of R&D: Previously a researcher at California State University and University of Alberta, MSc in Chemistry, PhD in Applied Chemistry.

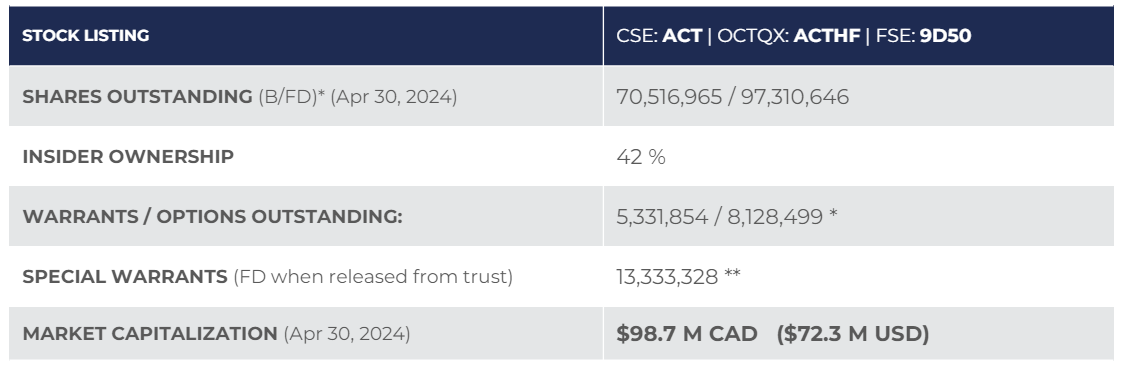

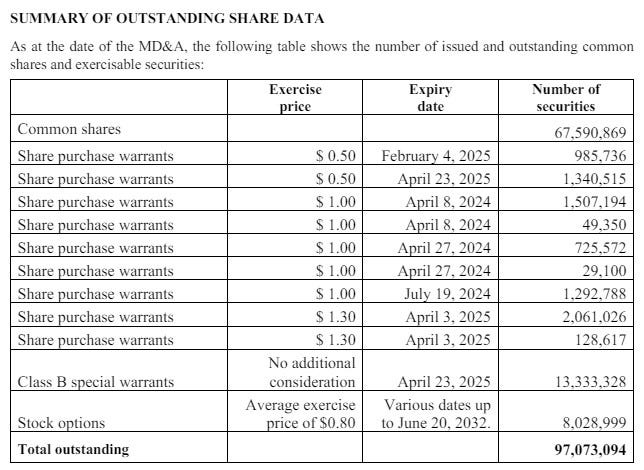

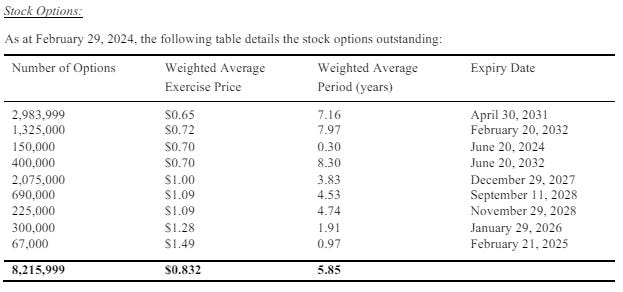

Share Structure

The total diluted shares outstanding is approximately 97M after accounting for warrants, options, and special warrants.

Insider ownership sits at approximately 42%.

Most of the warrants that expired in April were exercised, leading to Aduro receiving around $1.5M USD. More warrants should be exercised on July 19th, 2024, leading to another ~$950,000 cash injection for the company.

Approximately 150,000 options are set to be exercised on June 20th, 2024.

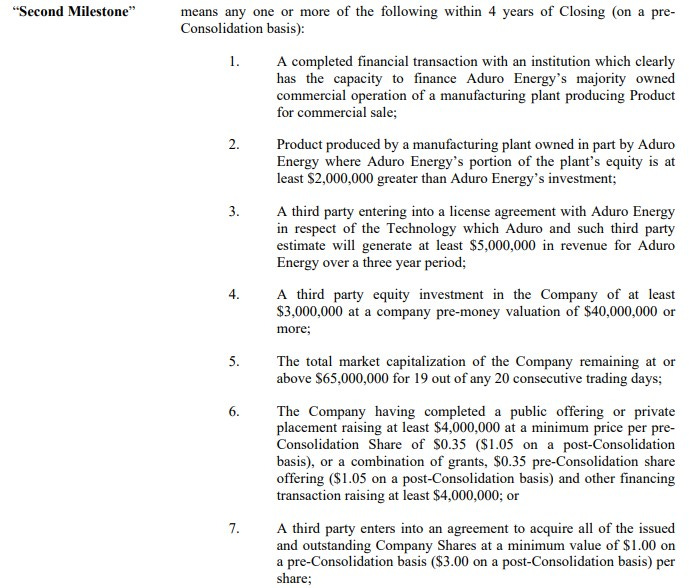

When Aduro went public in 2021 through an RTO with Dimension Five Technologies, the management team only took a third of the shares allotted to them. The other two-thirds of those shares were locked behind milestones as special warrants.

This is something you rarely see in the stock market in general… but especially in the microcap landscape. Management intentionally took steps to align their own incentives with those of retail shareholders through clear goals that brought the company closer to commercialization.

The first milestone was receiving third-party validation of their technology, which was achieved in 2022. The second milestone can be completed through the following ways:

Considering Aduro has already completed multiple goals on this list, I think the special warrants will ultimately be exercised on their expiry date, April 23rd, 2025. Either way, this “dilution” is guaranteed to happen as these shares are technically not included in the share outstanding count yet. Keep this in mind.

Financials

Aduro’s latest financial statements show that as of February 29th, 2024, the company had around $1.5M in cash. Warrants expiring in April brought in another $1.5M. The warrants expiring in July could bring in another $1M.

With a cash burn of approximately $500,000 per month, this would put the company at $1.5M in cash right now, considering three months have passed. Aduro recently announced a raise of another $1.5M, so the company will have ~$3M in the bank shortly.

The company has hardly any debt (~$350,000) and generated revenues of around $73,000 in Q1 2024. While Aduro is generating revenues from ongoing customer trials, the revenues aren’t particularly material at this time.

As mentioned earlier, building out the R3 pilot unit should generate around $1M-$6M in revenues, depending on the feedstock being recycled. However, the unit will require an estimated $3.5M-$5M in capex.

Considering the size of the raise, Aduro is likely sourcing additional funding from either a grant program or joint funds from one of the companies testing the technology. If not, another raise should be expected when R3 specifications have been finalized. The capital will have to come from somewhere.

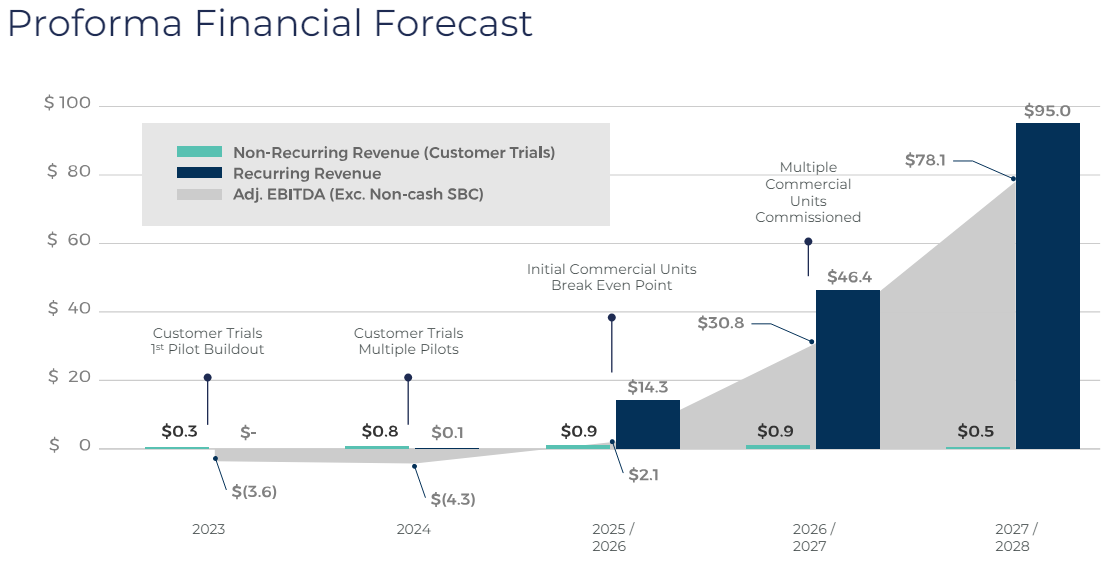

In the long term, the company expects to generate ~$70M in recurring revenues in 2027-2028. That would put the company at a recycling rate of around 400,000 tons per year based on their polyethylene scenario projections. Due to the capex-light business model, the EBITDA margins are projected at 80%. We are potentially still a few years out from any substantial revenues.

Management made this forecast with smaller players in mind, but at this point, the company has ongoing testing with six large companies. There’s a clear possibility that Aduro will blow past this financial projection, so growing into a valuation of over $1B is in play. Aka the Shell scenario.

I’m particularly interested in investing early in the case of a possible buyout offer. Aduro is a prime candidate for a buyout if the technology is proven out, depending on management’s view of the situation. I don’t know when that might ultimately happen, but I do know that I don’t want to be waiting on the sidelines if it does. Considering management owns nearly half of the stock, the decision will basically be up to them.

Risk Factors

Technology development is the company’s primary risk. The main question on every investor’s mind is: “How well will this technology scale?”

Patent protection, there’s always the possibility that competitors either try to copy or directly steal Aduro’s intellectual property. While it took the company over a decade to get the technology to this point, other companies will be determined to replicate their success.

The customer engagement program might deliver poor results, creating a lack of collaborators that will further fund the company and provide commercialization opportunities.

Funding risks are always a potential problem for a company of this size. Aduro is listed on the CSE and OTC exchanges, so capital could be difficult to come by, depending on the situation. Tangible revenues are still 1-2 years away.

Upcoming Catalysts

Aduro plans to convert at least 1-2 customers from the technology evaluation stage to the collaboration stage of their CEP program. This involves more rigorous testing, more funding, and sticker commitments.

Additional customers brought into the CEP program.

Development of the R3 pilot unit, ultimately being built in H1 2025.

Completion of the Shell Gamechanger program, or a complete report on results from R2 testing with bitumen and plastic waste. With that said, negotiations could easily prolong the release of any news.

Disclaimer: I’m long Aduro Clean Technologies. I hold an equity position that was acquired at an average share price of $0.69. I was not compensated by the company to create this post.

The owner of Green Investing is not a licensed investment professional. Nothing produced under the Green Investing brand should be construed as investment advice. My content is made for entertainment and educational purposes. Do your own research.

Hi! I've a question, why do u believe if the technology is proven out there will be a buyout? Shouldn't be otherwise?

Jesus fucking Christ! What an epic paper. I wonder how many people will read this. Aside from Mariusz and myself.