Aduro Clean Technologies - Business Update 1/26/25

A review of new financial statements and a recent fireside chat.

Aduro Clean Technologies (ADUR), a developer of novel plastic recycling technology, has recently released new financial documents and held a fireside chat.

Let’s review the updates they’ve provided.

Fireside Chat

Frankly, there wasn’t a ton of new information given. It was mainly an overview of the company and things we’ve heard before.

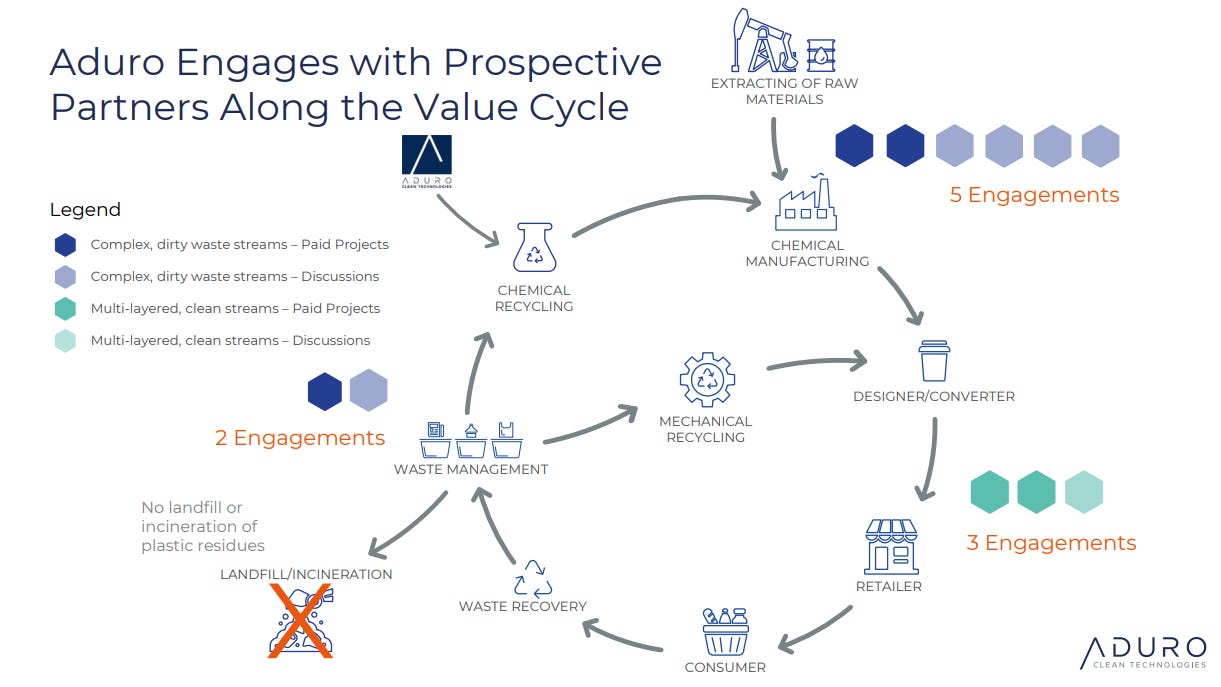

As of January 23rd, Aduro has 10 total customer engagements, and 7 of them are with paid customers. Many of those are multi-billion valuation firms in the petrochemical, building material, and food packaging industries.

Management confirmed that the collaborations with Shell and TotalEnergies are still ongoing but can’t offer any more details because of NDAs.

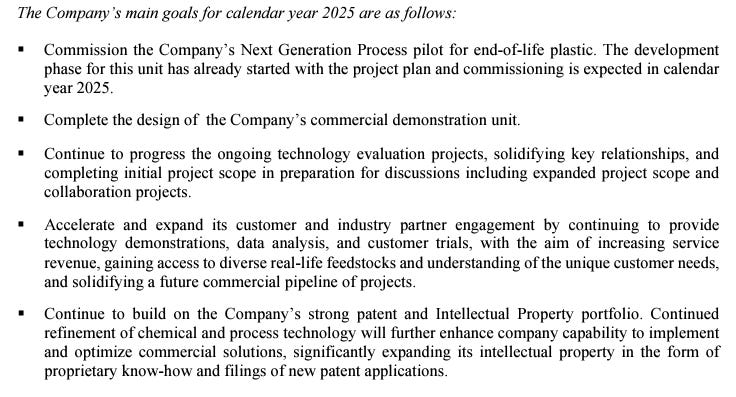

They have completed the basic engineering design for their next pilot plant, the Next Generation Process (NGP) unit. Aka the R3 unit. The plant is expected to be completed in Q3 2025.

The company has started to order long lead items for the facility and is working on a more detailed design phase.

Aduro is expanding its laboratory facilities and office space in London, Ontario.

Financials & Share Structure

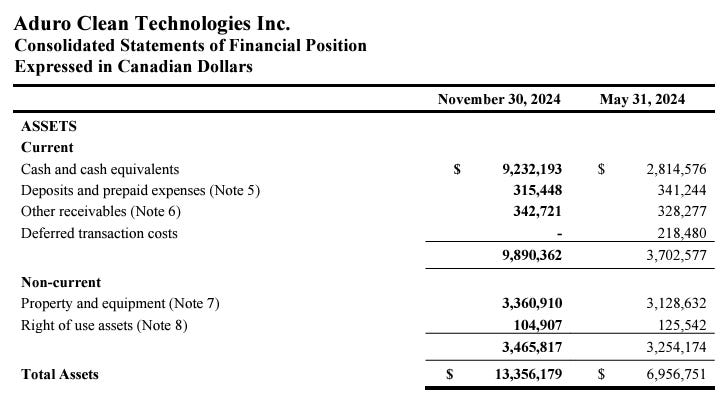

As of November 30th, 2024, Aduro had over C$9 million on its balance sheet, which should cover the construction of the NGP unit over the next few quarters.

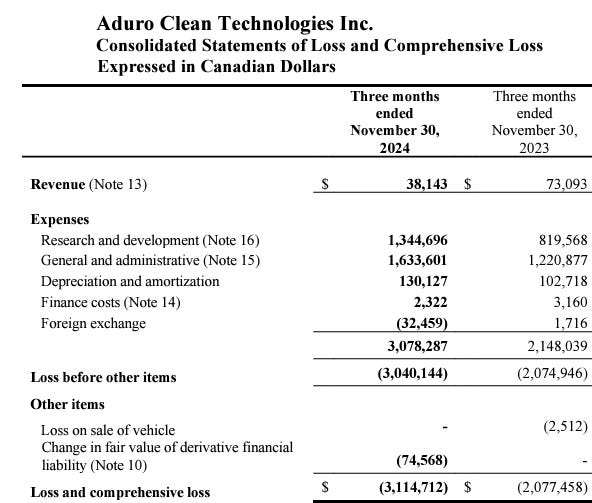

Revenues (while small regardless) have declined YoY. Management explained that this is due to more resources being used to design the NGP unit instead of testing recycling material for clients. All revenues for the next 1-2 years will be from testing in the customer engagement program until a commercial unit is built.

The comprehensive loss for the quarter was around C$3.1 million, increasing YoY primarily from increased R&D costs and growing G&A thanks to an upsizing in company headcount.

Total current and non-current liabilities are less than C$1 million

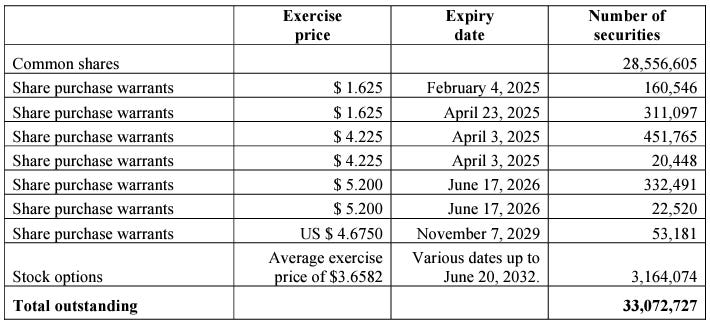

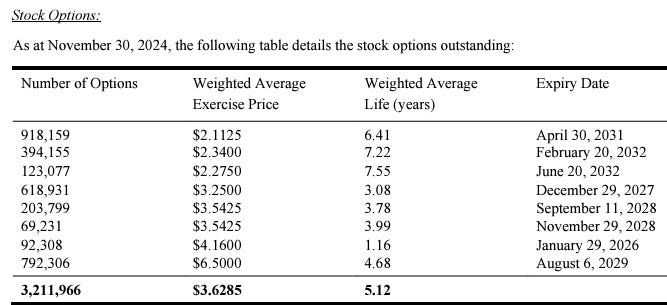

The total diluted share count is 33 million, as there are approximately 1.35 million warrants and 3.1 million stock options still outstanding.

Around 943,000 of those warrants are expected to expire this year.

None of the stock options are expiring this year.

Overall, there isn’t much new information to report on. I assume we’ll see a lull period here news-wise for the next 6-12 months unless we see some movement on the customer engagement front.

Disclaimer: I’m long Aduro Clean Technologies. I hold an equity position that was acquired at an average share price of $2.25. I was not compensated by the company to create this post.

The owner of Green Investing is not a licensed investment professional. Nothing produced under the Green Investing brand should be construed as investment advice. My content is made for entertainment and educational purposes. Do your own research.