SOLD - Base Carbon (BCBN) - Carbon Credit Financier

A contrarian nanocap on the cusp of inflecting to profitability.

See updates and investor call notes in the Base Carbon tag.

Note: All monetary figures are denominated in USD.

Highlights

Base Carbon (BCBN) is expected to generate ~$50M in revenues this year. In contrast to revenues of $6.5M last year. 2024 marks the start of profitability.

This will present an opportunity to funnel cash flows into a growing pipeline of potential sources for new carbon projects.

A DCF analysis concludes Base’s current carbon projects are worth an NPV of $1.17 per share. This indicates an upside from today’s share price of 235%.

BCBN has exposure to further upside potential via rising carbon credit prices, including corresponding adjustment premiums under the Paris Agreement.

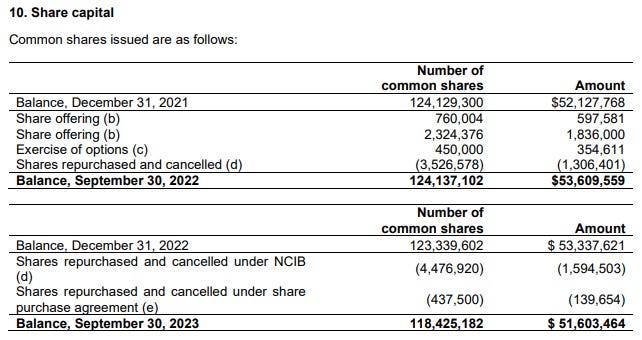

The company has an active NCIB; they continue to repurchase shares. From June 2022 to June 2023, Base bought back 7% of its total shares outstanding.

Stock Information

Name: Base Carbon

Market Cap: $43M

HQ Location: Toronto, Canada

Tickers: $BCBNF on the OTC, $BCBN on the CBOE Canada.

The Carbon Industry

Base Carbon (BCBN) is just one player in an evolving ecosystem of voluntary carbon markets (VCMs). The central thesis behind investing in the carbon markets relies on the entrenchment of fossil fuels in today’s economy.

“Hard-to-abate” emissions account for approximately 30% of greenhouse gas emissions. These include industries like cement, steel, trucking, aviation, etc. It’ll be significantly difficult to reduce CO2 output in these processes.

How are those emissions going to be accounted for when they’re difficult to abate? Carbon credits. Without the usage of carbon credits to offset those greenhouse gases, there’s no tangible path to a net-zero world.

Governments and corporations alike across the globe have declared their intentions to reduce their carbon footprints. Many climate commitments start to kick in between 2030 and 2050.

Yes, 2030 is still quite a ways away, but quality sources of carbon credits will be increasingly difficult to find. Prudent corporations will need to enter the markets beforehand to secure decent projects. The pressure rises the further along we get.

Considering the VCMs are estimated to have a market value of $2B currently… analysts are predicting the sector will grow by 5-125x over the next six years.

That’s a wide range, but the fact is that this sector is set to grow massively—no matter how you slice it.

As long as the world is pushing toward a transition to a green economy, carbon credits will be necessary. Don’t let hostile environmentalists try to convince you otherwise.

I highlighted a variety of financial incentives that will move companies further in the “green” direction in this article. This doesn’t even mention the increasing social pressures from local communities, environmentalist organizations, and climate scientists.

Given the context as to why businesses even bother offsetting their emissions with carbon credits… how does Base fit into this?

Business Model

Base Carbon is a carbon project financier. In essence, they provide upfront funding for carbon project developers. Once that developer successfully builds the carbon project that BCBN helped fund (reforestation, cookstoves, biochar, etc.), Base takes a percentage of the carbon credits or profits generated. The terms vary on a project-to-project basis.

In contrast to most of the other public companies in the carbon markets… Base didn’t opt for the royalty & streaming (R&S) model typically found in the mining space:

They wanted more exposure to the rising prices of carbon credits.

Projects in the carbon markets are significantly less capital-intensive to build than those in other commodities, so a good carbon project isn’t nearly as risky to capitalize.

Even in a bear market, the availability of capital for quality carbon projects dwarfs that of mining projects. In some ways, this can lower the need for developers to seek funding from R&S firms specifically. Great royalty deals can be harder to come by.

The management team’s choices have largely paid off so far.

Just two years after listing on the CBOE Canada (NEO) in March 2022, Base is the only public company involved in the VCMs generating notable levels of carbon credits.

With that said, much of that success came down to the projects they chose to fund.

Carbon Project Portfolio

Base’s focus when picking projects, at least for their first round of capital deployment, was on proven carbon methodologies (project types) with quick paybacks.

That initiative led them to improved cookstove projects. Particularly, two projects in Vietnam and Rwanda (they also have a third project focused on reforestation in India).

The improved cookstoves these projects distributed to rural communities can reduce emissions levels from cooking by 50-80%. All thanks to dramatically reducing the amount of fuel needed to maintain a fire.

This is in addition to all of the other health benefits that these projects provide to these communities. So overall, the funding Base provided has gone to a great cause. But, of course, as investors, we’re here for the monetary potential…

Vietnam (Cookstoves)

Registered with Verra (project #2923), this cookstove project is being developed in Vietnam by the Sustainability Investment Promotion and Development Joint Stock Company (SIPCO). SIPCO has distributed all 850,000 cookstoves and 364,000 water purifiers slated for the project. Water purifiers (project #2557) can also create carbon credits. Both cookstoves and water purifier credits are being sold for the same price.

Thanks to Base’s investment of $21M, the project is estimated to generate 45M carbon credits over 10 years. The first 7.4M of said credits have been locked into an offtake agreement with Citigroup for $5.75 a credit. As of the writing of this post, 1.1M credits have been delivered into this offtake so far, for revenues of ~$6.5M.

According to its latest corporate update, the company expects to receive issuances of approximately 6M carbon credits from Vietnam this year, which will generate revenues of nearly $30M. At that point, nearly all of the 7.4M credits in their offtake agreement will have been delivered. As for the other ~39M…

Base will have the right, but not the obligation to purchase the additional 39M credits estimated to be generated by the Vietnam project at a “prescribed price”. I assume that prescribed price will be $4, considering that’s the agreed prepayment price with SIPCO for the first 7.4M credits.

It can be a bit confusing, but essentially, SIPCO agreed to buy the first 7.4M credits back from Base Carbon for $4 to go and sell them to Citigroup for $5.75. Regardless, all of the revenue from that offtake goes to Base.

Even if Base buys those additional 39M credits from SIPCO for $4 a piece and sells them for $10 (gain of $6), a relatively low number in the grand scheme… these revenue numbers are significant. Base can also sell the credits back to SIPCO if they’d like to.

Why a price of $10? It seems likely they could get this project a corresponding adjustment label under the Paris Agreement as they did for the Rwanda project. More on that later, but having your credits eligible under Article 6.2 of the Paris Agreement leads to a major pricing premium right now. Management indicates the prices for these credits tend to be in the “low teens” so far.

Building out a DCF, I estimate the present value of the Vietnam project is $113.5M.

After reverse engineering the figures given in Verra documents, the theoretical number of carbon credits generated per year would be 5.1M from cookstoves and 780,000 from water purifiers. This was found by taking the results of the first project instance (10,000 cookstoves) and extrapolating out by 850x since the project distributed 850,000 cookstoves in total. The same was done for water purifiers.

Assuming a gradual decline in device usage, the project could generate $25-30M in revenues until 2031. The crediting period for water purifiers ends in 2031, and the cookstove’s ends in June of 2032.

In 2024, Base is still delivering into the offtake agreement at $5.75, and then the hope is that they’ll be selling the remaining 39M credits for $10+ after buying them for $4. How this ultimately pans out remains to be seen. Call me an optimist.

All revenues are subject to a 2.5% royalty from Abaxx Technologies, the company that originally spun out Base Carbon. I’m also assuming they’ll have operating margins of 90% for a while as this business is incredibly capital-light to operate. The company is only expected to burn around $1.1M a quarter after a consulting fee of $500,000 ended in Q3 2023.

Base Carbon Capital Partners Corp (BCCPC) is a wholly-owned subsidiary of Base Carbon and serves as the vehicle used to invest in all of Base’s projects. It also happens to be incorporated in Barbados :)

This subjects all of Base’s income to a rather low 9% corporate tax rate.

The last aspect to mention here is the discount rate chosen to find the present value of projected cash flows. 8% is being used for 2024 because those are the cash flows sourced from the Citi offtake. It’s a safe bet that revenue will roll in, so a low discount rate should suffice. 15% is in use for the rest of the years, on all projects, due to:

Additional risk related to possible changes with methodologies.

Uncertainty with credit volumes and pricing.

Political, operational, and jurisdictional risk.

These are the same assumptions that Base makes when calculating the DCF value of their projects. I find these criteria satisfactory.

Irrespective of a perfect timeline, their flagship project in Vietnam is set to generate mouth-watering levels of free cash flow for a company with a $43M market cap.

Base’s other projects are nothing to scoff at either…

Rwanda (Cookstoves)

The Rwanda cookstove program (project #4150) is in development with the project developer DelAgua. In total, Base’s investment of $8.8M led to the production of 250,000 improved cookstoves. As a registered project, DelAgua also included another 150,000 cookstoves, so Verra documents are designed around estimates for 400,000 cookstoves.

Project documents indicate that the average number of emissions reduced per year will be around 1.8M. Given Base’s 250,000 share of the 400,000 cookstoves… this equates to 1.1M credits per year.

BCBN has a profit-sharing agreement on the first 7.5M credits the project produces. Base is guiding for credit issuances of 2.1M this year. They will receive 90% of the profits on the sale of those credits. The remaining ~5.3M will provide less upside, where Base receives 30% of the profits. Assuming a gradual decline in device usage with 1.1M credits coming in per year… Base’s share of the project will end in 2029-2030.

Chances are, all of the credits generated will be sold for $10 or more, thanks to the Rwanda project receiving a corresponding adjustment (CA) label under the Paris Agreement. Some credits with this stamp of approval have even been sold as high as $20-25. Base’s management has indicated they’re currently seeing pricing in the “low teens” as of their last investor call with Water Tower Research.

Under Article 6.2, the Paris Agreement requires that carbon projects receive a CA label to ensure carbon credits aren’t double-counted under several countries’ nationally determined contributions (climate goals). As mentioned earlier, the relatively low numbers of projects that have received this label go for significant pricing premiums compared to other projects in the VCMs.

Just as Base did for the Vietnam project, management is focused on searching for potential offtake agreements that can ensure they have buyers. With that said, management is in no hurry to sell any credits if they aren’t getting fair pricing.

A DCF estimation puts the present value of the Rwanda project at $21M.

The valuation is impacted directly by the company’s focus on securing projects with quick paybacks early on. They’re trying to frontload revenues/profits to have that capital ready to deploy into new projects.

According to Verra’s website, approximately 1.37M credits had been issued from the project as of 2/29/24. As we haven’t seen a press release from Base yet, we should expect to see them release news and receive their first credits from the project shortly.

India (Reforestation)

The India reforestation project (currently unregistered) is being developed by Value Network Advisory Services (VNV). Its efforts consist of planting 6.5M trees, which was estimated to be completed by January 2024.

Base is investing $13.6M in total, of which $7.3M should already be invested. In addition, another $6.3M should be dedicated to maintenance capex over the next 10 years.

The planned output for the project is 1.6M credits issued in equal tranches over the span of 20 years. So clearly, this is the lowest number of credits generated from any of Base’s projects. The first credit issuance is expected to take place in early 2025. That was the main selling point of the project.

Most reforestation projects can take 5+ years to start generating any carbon credits as the trees need time to grow. Base was attracted to this project for several reasons:

They wanted to partner with VNV, an experienced operator, who could collaborate with Base on more projects in the future.

This project was expected to begin generating credits in a quick time frame.

Reforestation is a highly desirable carbon methodology, so these credits tend to trade upwards of $15-20. That’s without any influence from a CA label.

In a DCF analysis, the present value of the India project is $4.3M.

What would change the equation is if Base is able to attract a potential buyer for a pre-purchase agreement. In that case, the earnings timeline would be dramatically faster as the buyer would pay upfront for consistent supply.

Viridios Capital, a VCM solutions provider and AI platform, provides a range of prices they see in the markets. The average tends to go around $10-12 for reforestation. In many cases, high-quality projects attract higher pricing, so I went with an estimate of $20 for these credits.

On paper, this is Base’s worst project, but it opens new doors for them with VNV, and a pre-purchase agreement can provide additional capital to reinvest into their project pipeline. Assuming they manage to take advantage of it, I can see the vision.

Valuation

Combined, with a total NPV of $139M, Base’s project portfolio is worth $1.17 per share. This equates to an upside of 235%. Additional upside is possible from higher credit pricing or pre-purchase and offtake agreements. Not to mention new projects.

To be fair, if the Vietnam project never gets a CA label, then the 39M credits outside of the existing offtake would likely only be sold for a gain of $1-2. That would bring the upside on an NPV basis down to about 90%. Yearly revenue from 2025 and beyond from Vietnam would drop from ~$30-25M to ~$10M.

Anyway, if you’d like to go the multiples route, assuming Base makes $30M in net income this year… slap a modest 10 PE on that (hated industry) and you can see how the company could be valued at $300M+. Current market cap, $43M. No matter how you’d like to approach it, the company isn’t being valued fairly.

The carbon industry is despised at the moment, due to a variety of reasons:

The unproven nature of many carbon methodologies.

Fears of “greenwashing.”

Political bias.

I could go on.

There’s a never-ending list of potential factors that turn people away from the space. This can either be seen as a contrarian opportunity or a reason to look elsewhere.

Regardless, Base Carbon is going to continue advancing in the industry…

Project Pipeline & Development Partners

In previous investor calls, Base’s management has emphasized looking for new projects that are nature-based. Particularly, project types like reforestation, afforestation, and biochar— methodologies attracting higher credit prices in today’s market.

Base Carbon has a variety of partnerships in place that could help in sourcing additional projects:

An LOI with the Danish Red Cross to explore potential blue carbon projects in Southeast Asia. The agreement’s 24-month term ends in November 2024.

Additional projects with the developers Base is already working with.

An LOI with the STX Group, one of the largest carbon trading organizations in the VCMs. The concrete details on exactly what this partnership will entail are still being determined. All we know for sure is that Base and STX are working on forming some type of “investment vehicle.”

Management has also been searching for other non-dilutive methods of bringing in additional revenue. This partnership will likely be one of them.

Existing coordination with Hardwick Climate Business Limited (HCBL). This partnership ends on June 30th, 2024.

HCBL

HCBL is a consulting company with extensive experience in the VCMs. Base originally planned on fully acquiring HCBL to bring in their knowledge base, but for unknown reasons, the deal was restructured. Here are the details as of May 10th, 2023:

HCBL used to jointly own a portion of BCCPC, Base’s subsidiary that invests in all of the carbon projects. At this point, Base bought back their interest in the vehicle, so Base now retains 100% ownership of their projects.

Base Carbon still owns a 15% equity stake in HCBL.

If HCBL originates a project for Base, they’re paid a 3.5% origination fee. They were also paid a consulting fee of $830,000.

Philip Hardwick was the COO of Base and subsequently stepped down, reverting to his role as CEO of HCBL.

Hardwick still has 2,324,376 shares of BCBN stock that are under escrow until June 30th, 2024. He also has 500,000 options with an exercise price of $1.00 CAD.

It’s unknown how great of terms Base and HCBL are on at this point. I am assuming it’s at least decent, considering both parties still have equity stakes in one another. The shares/options could create some negative selling pressure if Hardwick wants out.

Other Partnerships

Abaxx Technologies (ABXX) is the company that originally spun out Base Carbon, and the companies have several potential opportunities for collaboration:

Firstly, Abaxx still retains a 2.5% royalty on all gross revenues that Base generates, along with holding a 16% equity stake in the company.

In return, Base can license Abaxx’s measurement, reporting, and verification (MRV) technology to increase certainty around transparency and tracking carbon credits, as well as other commodities.

In addition, there’s potential that both Abaxx and Base could be working together on what Abaxx has called “Project Venice.” This is an early-stage pilot project that leverages Abaxx’s blockchain technology to securely connect market participants in the relatively opaque voluntary carbon markets.

Base Carbon owns a 5% equity interest in AirCarbon Exchange (ACX Holdings), a leading environmental markets exchange, thanks to Abaxx transferring that equity over to Base.

Management Team

I’ve mentioned the management team numerous times in this post, but who are they?

Base’s team has extensive experience in commodity markets, portfolio management and M&A activity. This can be helpful, as their business model depends on that type of deal-making experience.

For example, their CEO, Michael Costa, was previously the head portfolio manager at CMP Funds, as well as working at UBS Canada Principal Investing and in the Goldman Sachs Canada Special Situations Group.

What I always thought was a bit lacking though, at least early on, was their experience in the voluntary carbon markets themselves.

Their Director of Origination, Svenja Telle, had previous experience focused on the direct air capture space, which is nice to have, but that industry is too early-stage to invest in. She appeared to be capable, but it seemed like cookstove projects might not be in her immediate wheelhouse, for example.

This was where HCBL helped fill the gaps, but as mentioned earlier, that partnership is set to end relatively soon. At this point, Base has been operating for several years, so the situation isn’t nearly as dire as it looked before. The team has inevitably learned a lot since they started, and the company has clearly been progressing far better than its competitors in the public markets.

So, I’m not worried about their ability to evaluate projects like I was before when it seemed like the HCBL partnership was starting to get shaky. In the worst-case scenario, they’ll have the capability to source additional talent if needed. They’re about to be raking in cash shortly.

Share Structure

As for insider ownership, management owns about 12% of the company. Abaxx Technologies retains a 16% interest in Base. Robert Friedland, the mining industry billionaire, owns 6% of the company as well.

Management has previously remarked that another 20-25% of the investor base could be considered “sticky.” This has led to Base having a very tight float and low levels of liquidity.

As of September 30th, 2023, the company had a balance of nearly 7M stock options outstanding. Given the stock's current price of around $0.35, most of these options are being forfeited right now.

The current outstanding share count, as of September 30th, 2023, was ~118.5M. The company continues to engage in a share buyback program, so this number is inevitably going to be lower in March of 2024. But these are the company’s latest financials.

Financials (Sep 23)

As of September 30th, 2023, Base had $3.8M in cash and cash equivalents. Again, given their expectations of receiving nearly 8M credits in total throughout 2024, the company has no need to raise money ever again. Management has continued to stress this in every interview they’ve had. Base is largely against the use of debt or dilution at this point unless the right opportunity emerged.

The company currently has no debt. In fact, funnily enough, they were loaning money to Abaxx Technologies at one point. Abaxx was strapped for cash as they were negotiating with strategic investors, so Base loaned them money in an effort to stave off dilution. Anyway…

The company burned $1.7M in Q3 2023, as I pointed out before, $500,000 of those consulting fees were set to go away after that quarter. So the expected burn rate is $1.1M.

It’s worth noting Base is also beginning to dedicate some funds to the initial development of technology and software tools. So, that’ll receive a budget of $500,000 throughout 2024.

Additionally, as you can see from the statement of operations, Base was technically profitable last year. This is due to how the company accounts for its projects. The “gains on investments in carbon credit projects” are the unrealized gains from the entire life of a carbon project after Base creates its own DCF. So, that $111M they estimate they’ll make from the Vietnam project was technically contributing to the company's profit/loss.

This is done when the projects release their first issuance of credits. The same will be done for the Rwanda project when its credits are received. This can skew the numbers a bit. With that said— Base should generate notable cash flows in 2024, not just unrealized gains.

Risk Factors

Carbon markets are extremely out of favor, and this can lead to Base’s stock being neglected, as it has been. We’ll see if financial viability turns that around.

Carbon markets have existed for decades, but as we’ve seen with Verra, the industry is still prone to change. Reworking methodologies could potentially impact the number of credits Base receives. In an extreme scenario, it could even lead to projects being halted entirely.

Base’s projects are not exactly located in the first jurisdictions you think of when you think “safe.” Rwanda, Vietnam, and India could shift how they govern the carbon markets, and that could impact the company.

Verra has been prone to seeing delays, which can affect credit issuances. This could hinder revenue projections.

The HCBL situation could create a negative overhang on the stock if Hardwick decided he wanted to begin selling his shares that are coming out of escrow soon.

Price premiums are emerging among credits that get corresponding adjustment labels or validated under the Core Carbon Principles standards developed by ICVCM. If Base doesn’t qualify in these aspects, then that can negatively affect the pricing or demand for their credits.

Upcoming Catalysts

Significant cash flows and likely profitability in 2024.

8.1M credits are set to be issued from the Vietnam and Rwanda projects. This represents approximately $50M in revenue.

Announcement of offtake and pre-purchase agreements or corresponding adjustment approval.

Additional developments from their various existing partnerships and a growing pipeline of potential projects.

Further details on the company’s investment vehicle with the STX Group.

Disclaimer: I’m long Base Carbon. I hold an equity position that was acquired at an average share price of $0.35. I was not compensated by the company to create this post.

The owner of Green Investing is not a licensed investment professional. Nothing produced under the Green Investing brand should be construed as investment advice. My content is made for entertainment and educational purposes. Do your own research.

Thank you for the great overview of the company, it's business model and it's earning power.