Base Carbon (BCBN) has released updates on its carbon credits projects:

Vietnam

Base could receive another 1.8 million carbon credits from the Vietnam cookstove project as early as the end of the quarter.

So far, they’ve received approximately 5.2 million credits from the project. Generating $30 million in revenues and achieving total project capex payback already.

This next issuance will nearly fulfill the offtake agreement with Citi, which was for 7.4 million credits. As noted in the April investor call, the profits from this next tranche will be split 50/50 with SIPCO.

Management has confirmed they would proceed with Phase 2 of the Vietnam project if they received a corresponding adjustment label for Vietnam… so we await to hear if they can snag that regulatory approval. That’s the “call option” Base has to purchase an additional 25 million credits for $5 per credit from the project.

Rwanda

The cookstove project in Rwanda is set to generate another nearly 1 million credits in “the coming weeks.”

This would bring the project’s carbon credit production total to 1.7 million after their last issuance of ~720,000 credits.

Base currently holds around 700,000 of those credits in inventory. The company is awaiting potential inclusion into the CORSIA program to sell those credits.

India

Value Network Ventures (VNV), the project developer collaborating with Base Carbon, has announced the completion of planting all 6.5 million trees associated with the India reforestation project.

Project validation is ongoing with Verra, and Base anticipates that the project will start generating credits in Q1 2025.

Regulatory/Oversight Body Updates

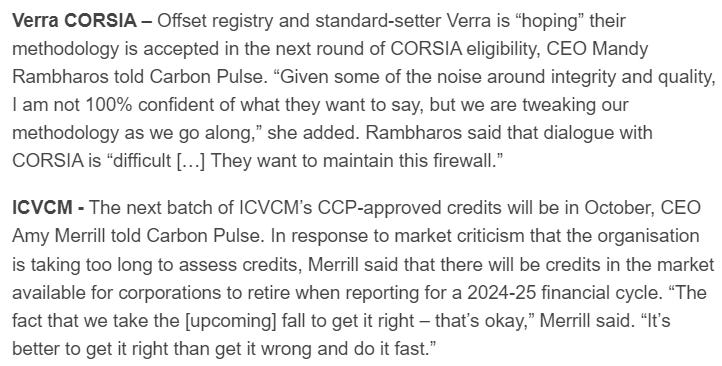

Verra, the carbon registry that oversees all of Base Carbon’s projects, has released a new cookstove project methodology (again).

Base isn’t required to utilize it immediately, but it is expected to apply to all Verra-registered cookstove projects from 2027 and onwards.

It’s unclear if this will impact potential issuance numbers from Vietnam and Rwanda as the last methodology update did.

Base is also awaiting news from both CORSIA and ICVCM on the future pricing of its cookstove credits.

Verra being accepted into CORSIA will be a huge step in supplying additional carbon credits to an undersupplied market. This would also allow Base to potentially begin selling its carbon credits from Rwanda for significant market premiums.

The cookstove methodology being approved under ICVCM’s Core Carbon Principles (CCP) would also be notable in ensuring that Base’s cookstove projects would be seen as more credible to institutional players.

We should see news from both of these oversight bodies in the coming months.

Disclaimer: I’m long Base Carbon. I hold an equity position that was acquired at an average share price of $0.35. I was not compensated by the company to create this post.

The owner of Green Investing is not a licensed investment professional. Nothing produced under the Green Investing brand should be construed as investment advice. My content is made for entertainment and educational purposes. Do your own research.