Green Capital is a daily series dedicated to tracking capital flows and emerging opportunities in environmental markets. Notable events include green investment deals, start-up fundraising, and new public listings.

Deals/Fundraising

char.gy, an electric vehicle charging company, has secured £100M to expand its charging network from 3,000 to 100,000 charge points by 2030.

Omnigen Energy has secured $46M in financing from Itaú BBA to develop its portfolio of 20 small-scale solar power plants in Brazil.

SENCO Hydrogen Capital, a private equity firm focused on hydrogen, is investing €20M in Strohm, an international manufacturer of pipeline technologies. The capital will be used for hydrogen and carbon capture applications.

HyFive, a green hydrogen derivatives and infrastructure platform, is investing €250M in building a green hydrogen and methanol plant in Gijon, Spain.

HAV Hydrogen and Norwegian Hydrogen have received ~$30M in funding from Enova (owned by the Ministry of Climate and Environment in Norway) to build five hydrogen-powered dry-bulk ships. The vessels will be operated by Maris Fiducia Norway.

SUEZ Group, a global wastewater recycling firm, has won a $545M contract from Taiwan's Water Resources Agency to design, build, and operate a large-scale desalination plant in Hsinchu City, Taiwan.

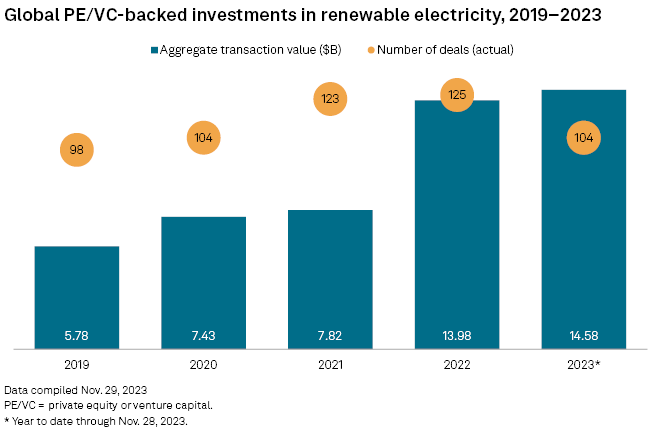

According to S&P Global Market Intelligence data, private equity and venture capital investments in renewable energy have been rising. In 2023, these investments totaled to nearly $15B.

Start-Up Investments

Bisly, a sustainable building solutions company, has raised $6.7M in a funding round to expand its European operations.

Brighte Energy, a solar financing provider, has received $195M in capital from a green debt facility primarily operated by National Australia Bank.