Green Markets is a weekly series dedicated to highlighting events of interest or developing trends within environmental markets. The emphasis is on news that could impact investable opportunities in public stock markets.

New Collective Quantified Goal

As far as solving climate change is concerned, a few key initiatives have emerged from the Conference of the Parties (COP) meetings. One of those is an agreement on The New Collective Quantified Goal on Climate Finance (NCQG).

The NCQG is set to replace a previous goal of providing $100B per year of financing for environmental efforts by 2020. Now, that number serves as the floor for what the new goal might be.

Talks among experts taking place from April 23 to April 26 are going to decide how this funding will be sourced and tracked. Additionally, this will serve as one of the main focal points during events at the COP 29 summit in November.

According to BloombergNEF, funding toward green initiatives is at an all-time high. I don’t expect the movement of capital into these sectors to stop any time soon.

This is why I fixate on the energy transition when choosing investments. Few other trends have these types of growth expectations.

VCM Supply Glut

In a previous post, I mentioned how we could see a supply crunch in the voluntary carbon markets (VCM). So how can I reconcile recent data from Carbon Pulse detailing how the VCMs have an excess supply of nearly one billion carbon credits?

Theoretically, there’s a massive oversupply of carbon credits. The average demand for carbon credits over the last few years was around 160M per annum, according to data from the Berkeley Carbon Trading Project. Just the existing credits in circulation could supply the market for 5-6 years. That’s assuming demand stays constant though.

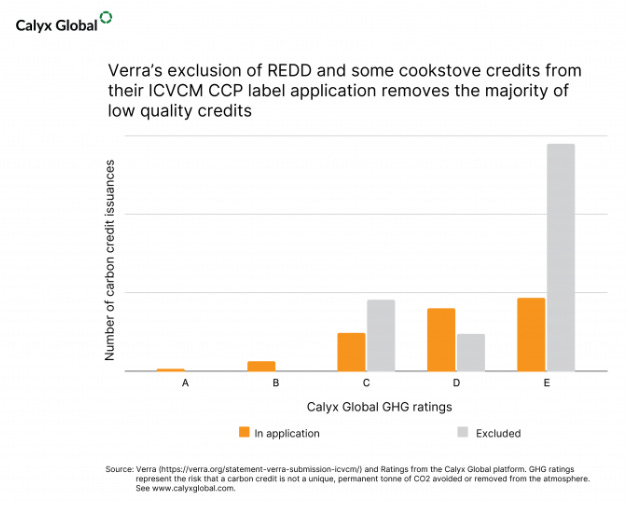

Regardless, what we need to keep in mind is the quality of those credits. Donna Lee, the co-founder of Calyx Global, a carbon project rating service, outlined how we might see the markets evolve beyond most existing supply.

If many of the poorly rated REDD+ and cookstove projects were to be rejected by ICVCM’s criteria for their Core Carbon Principles… then that would dramatically reduce viable supply.

Verra already excluded old REDD+ projects from being viable for the Core Carbon Principles label, this represents 27% of the market.

In that same vein, if the credits sourced from renewable energy projects were to be cast away… then this would essentially eliminate another large swath of old credits.

Registries like Verra and Gold Standard have already discontinued the ability for most renewable energy projects to register on their exchanges. These projects are largely financially viable on their own— they have no need for carbon finance anymore.

Combined, removing these methodologies would eliminate approximately 50% of the oversupply right there. Add in other quality measurements like the CCP label, corresponding adjustments under the Paris Agreement, etc., and that oversupply begins to dwindle rapidly. It’s actually going to be quite difficult for corporates to garner an adequate supply.

As the carbon registries, standards bodies, and regulators tighten restrictions in these markets— supply should continue to constrict. At the same time, demand is only set to increase as climate commitments get closer by the day. This is the thesis behind investing in the VCMs in a nutshell.

Stock(s) set to benefit from this news: Base Carbon

ICVCM’s First Approvals

The Integrity Council for Voluntary Carbon Markets (ICVCM)’s stringent standards for carbon projects are making a big splash in the VCMs. The Core Carbon Principles (CCP) are emerging as a benchmark for what high-integrity carbon credits should be.

On April 6th, ICVCM announced the first carbon registries that are allowed to quality under the CCP rules. American Carbon Registry, Climate Action Reserve, and Gold Standard have all met the initial criteria.

Other registries, such as Verra, ART TREES, Social Carbon, and Isometric, will be assessed by May, at the latest.

While some registries have been approved for CCP eligibility, they must also have all of their methodologies examined. The ICVCM is already assessing over 100 different carbon methodologies for eligibility.

CCP status will seemingly play a large role in demand, as these standards are seen as higher quality. Contrary to what you might first assume, buyers do not typically prioritize scooping up the lowest-cost credits they can. If they’re going to participate in these markets, they want to ensure that the carbon credits they’re buying are real. Otherwise, this can result in a disaster for public relations… meanwhile, the point of purchasing those credits in the first place was for good headlines.

New ARR Spot Contracts

The Climate Impact X (CIX) carbon credit exchange has launched the trading of two new afforestation, reforestation, and revegetation (ARR) spot contracts:

CIX ARR X (CAX): A basket of 12 ARR projects from around the globe.

CIX ARR X (CAX-C): A basket of projects in China issued by Verra.

On April 4th, CAX traded for $13.10, and CAX-C traded for $4.36.

CIX competes with other exchange operators like CME Group and ICE, which have created their own contracts in the space. However, CME and ICE are primarily offering futures contracts, not spot contracts.

It’s also worth noting that Abaxx Technologies is on the cusp of launching a new commodity exchange offering REDD and CORSIA carbon futures.

Competition in the VCMs to create new financial products is on the rise. There are currently no leading pricing benchmarks in the industry, as most trades are done over-the-counter. This presents a significant opportunity for companies to establish a foothold in an industry that’s set to 5x or more in size by 2030. That’s an estimate from Shell, not exactly a company that’s fond of that idea…