Green Markets is a daily series dedicated to highlighting events of interest that could impact investments within environmental markets.

Government/Regulatory

The World Bank has issued a $225 million, nine-year bond linked to reforestation efforts in the Amazon rainforest, marking its largest outcome bond to date. This bond, which matures in 2033, is unique in that it ties investors' financial returns directly to carbon removal from reforestation projects in Brazil's Amazon. Approximately $36 million from the bond will support the reforestation activities of Mombak, a Brazilian company, with Microsoft committed to purchasing the carbon removal units.

The SEC has defended its climate disclosure regulation amidst ongoing legal challenges, arguing that the rule falls within its statutory authority despite the recent Supreme Court decision in Loper Bright, which overruled the Chevron doctrine. The SEC contends that the regulation adheres to the core provisions of securities laws that authorize it to establish disclosure requirements. This argument aims to demonstrate that the SEC’s authority is clearly defined and should be upheld even without Chevron deference. The outcome of this defense will be determined as the litigation progresses in the Eighth Circuit.

Goldman Sachs' fund division is withdrawing from the Climate Action 100+ investor group, joining other U.S. financial firms that have exited amid political backlash. The withdrawal is driven by criticisms from Republican lawmakers who argue that the group's climate goals could breach antitrust rules. Goldman Sachs cited its ability to independently engage on climate issues and remain committed to sustainable investing. Other notable exits include firms like Invesco and JPMorgan’s fund division, reflecting a broader trend of financial services companies distancing themselves from climate-focused coalitions.

Egypt's green transition is advancing with the establishment of the Environmental and Climate Policy Committee. The committee, comprising representatives from various key ministries, aims to coordinate Egypt's climate strategy and green policies. The committee will utilize insights from an OECD report to guide policy-making and facilitate international financing.

China has launched a comprehensive green transition guideline aimed at transforming its economy and society over the next decade. The plan focuses on the goal of establishing a greener, low-carbon circular economy by 2035. Key targets include expanding the energy-saving industry, increasing non-fossil energy consumption to 25% of total energy use, and promoting the use of clean energy in public transportation.

Approximately 40% of major manufacturing projects funded by the Inflation Reduction Act (IRA) and Chips and Science Act have faced delays or pauses, according to a Financial Times investigation. Out of $227.9 billion worth of projects tracked, $84 billion are delayed due to market conditions, slowing demand, and policy uncertainty.

Battery Metals

Workers at BHP's Escondida mine in Chile, the world's largest copper mine, have gone on strike after failed labor negotiations, demanding a larger share of profits amid high copper prices. The strike, involving about 2,400 frontline workers, has led BHP to activate a contingency plan, though details are not provided. While the market remains calm, analysts warn that this strike could set a precedent for other labor disputes in Chile.

Related Stock List(s): Commodity Trust Stocks, Commodity Royalty Stocks

Biofuels/Chemicals

Honeywell and Jiutai Group have partnered to produce 100,000 tons of sustainable aviation fuel (SAF) annually using Honeywell’s technology, which converts eMethanol into low-carbon jet fuel.

Archaea Energy, now a BP subsidiary, has acquired Sunshine Gas Producers, resolving a lawsuit involving missed payments at the Sunshine Canyon Landfill. The legal dispute arose from allegations that Sunshine Gas Producers failed to make payments for excess landfill gas while delaying the construction of a planned RNG plant. The lawsuit, which sought $8 million in damages, was dismissed in April 2024. The partnership between Archaea and Republic Services, which launched the Lightning Renewables joint venture, continues to advance with the goal of expanding their landfill-gas-to-RNG projects.

Carbon Capture

Australian firm InCapture has received government approval to evaluate a large offshore area for a carbon capture and storage (CCS) project in the North West Shelf region. The project aims to become operational by the early 2030s and will cover over 6,500 square kilometers near Dampier and Port Hedland.

Related Stock List(s): Carbon Capture Stocks

Electric Vehicles

Volkswagen has delayed the launch of its new Trinity EV project, including the new ID.4 model, to the early 2030s. The postponement follows software issues at the Cariad subsidiary and weak demand for electric vehicles, leading the company to adjust its plans and focus on a new version of the existing MEB platform for a 2026 release. The decision to push back the SSP platform models was made to address cost concerns and streamline production. The company still plans to release an electric Golf on the SSP platform later this decade.

New York Governor Kathy Hochul has announced an additional $200 million in funding for zero-emission school buses through the second phase of the Clean Water, Clean Air, and Green Jobs Environmental Bond Act. This funding, administered by NYSERDA, supports the purchase of electric buses, charging infrastructure, and fleet electrification planning. The incentives cover up to 100% of the additional cost for electric buses and provide vouchers for installing charging stations.

Related Stock List(s): Electric Vehicle Stocks

Liquified Natural Gas (LNG)

Karpowership has unveiled a $1 billion plan to develop an LNG-to-power infrastructure in Mozambique, aiming to boost the energy landscape of southern Africa. The project will feature a 500 MW facility, including a large Powership and a Floating Storage Regasification Unit (FSRU).

Brazil is turning to LNG to counteract power shortages caused by a severe drought impacting its hydropower reservoirs. State-owned Petrobras is seeking six LNG cargoes for delivery in September to address reduced water levels affecting energy production.

Related Stock List(s): LNG Stocks

Nuclear Energy

India and Russia are enhancing their nuclear energy collaboration through a $1.2 billion deal to establish a joint venture for nuclear fuel production. This agreement involves Russian fuel company TVEL supplying nuclear fuel to the Kudankulam Nuclear Power Plant in Tamil Nadu from 2025 to 2033.

Related Stock List(s): Nuclear Energy & Uranium Stocks

Renewable Energy

Ukraine has approved a $20 billion investment plan to boost its renewable energy production. The plan aims to increase the share of renewables in the country's energy mix to 27% by 2030. This includes adding approximately 10,000 MW of new generation facilities, with specific targets for renewables in the heat, electricity, and transport sectors. The government will also issue tenders for new generating capacities, with some projects expected to be operational by 2027.

Railpen, one of the UK's largest pension managers, and Scottish renewable energy firm GreenPower have announced a joint venture to co-develop a 66 MW onshore wind project in North Argyll. This project, which is in the pre-planning consultation stage, is considered a 'sister' to their existing 46 MW Carraig Gheal wind farm.

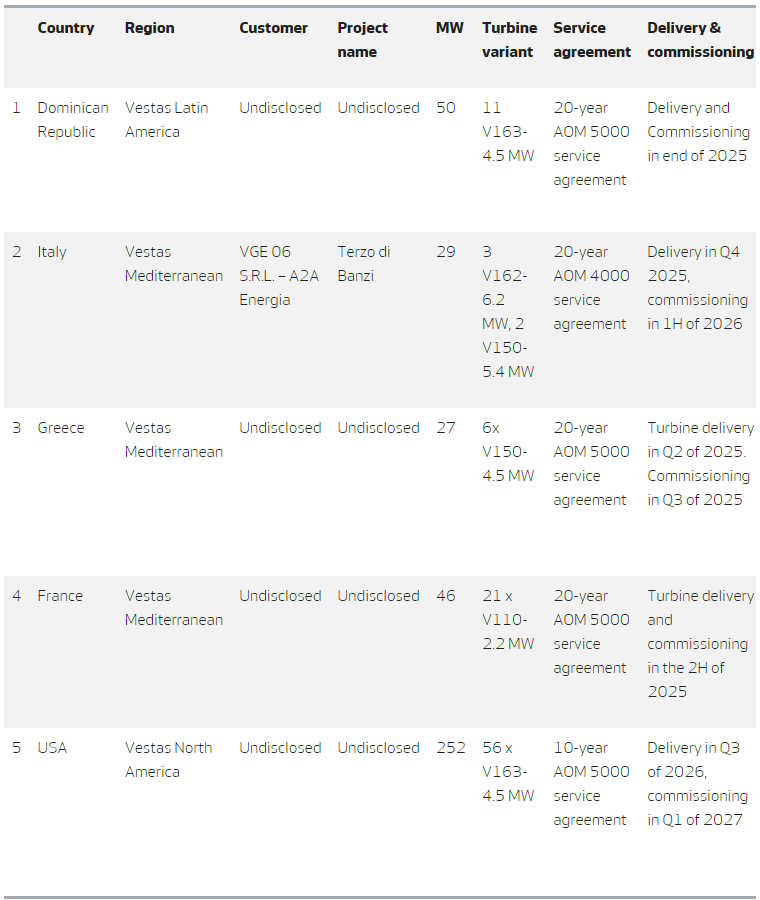

Vestas, one of the largest wind energy developers, recently received five orders, totaling in over 400 MW of wind power generation:

Investment Funds

Stafford Capital Partners has made its first investment in its debut carbon-offset timberland fund, allocating $70 million to acquire assets. The Stafford Carbon Offsets Opportunities Fund, backed by UK local government pension schemes, invested $60 million in degraded pastureland in southwestern Brazil and $12 million in pine planting properties in New Zealand.