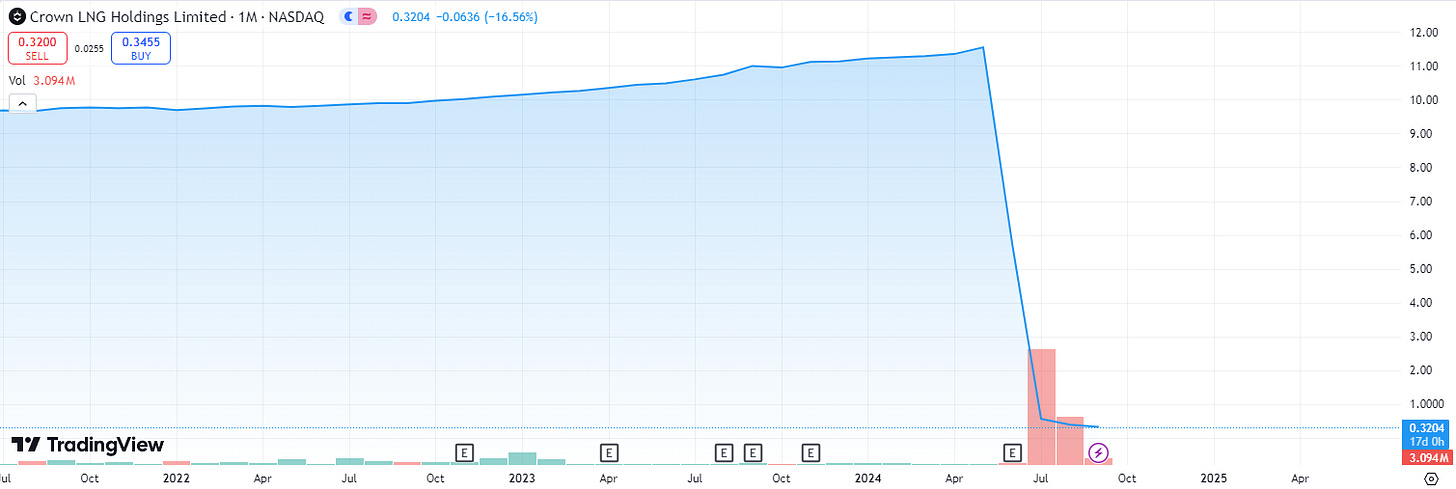

Crown LNG Holdings (CGBS) merged with Catcha Investment Corp through a recent SPAC combination, which was completed on July 9th, 2024. The company is now listed on the Nasdaq and has already received a delisting notice.

I recently made a video about the company’s fundamentals on YouTube.

It seemed like a relatively promising investment opportunity, so what’s with the sell-off in the stock?

Typical SPAC Behavior

Unfortunately, immediately after many SPACs and other public listings, it’s common to see early investors or even management themselves cash out of the stock.

Going public is seen as a “pay day,” and many of the largest investors in these deals will take that to the bank.

If there isn’t a lock-up in place, you get exactly what’s happened to Crown LNG’s stock price.

The SPAC transaction consisted of expectations that:

Crown LNG shareholders would still have 83% ownership of the company

Catcha Holdings (SPAC sponsor) would own approximately 10%

Existing SPAC shareholders would be at 3%

PIPE investors would have around 4%

Looking through their filings, insider ownership in Crown LNG was at approximately 51% as of 2022. There didn’t seem to be any updated figures on that:

That ownership percentage has been diluted at this point, but this would represent a significant allocation of the stock. Approximately 35% of the ~70M shares outstanding.

In many SPAC deals, insiders and sponsors have been subject to at least a 12-month lock-up period for their shares. This wasn’t the case for Crown.

On July 23rd, under section 5(b) of their lock-up agreement, a majority of the owners of lock-up shares waived the agreement, allowing both insiders and the SPAC sponsors to sell their stock.

There isn’t a way to know for sure, but management probably sold most, if not all of their shares.

As a foreign private issuer (Norwegian company) listed in the United States, insiders aren’t required to publicly disclose their stock trades in a Form 4.

Additionally, their Chairman stepped down as of August 2nd. That could be five million shares right there.

While we don’t know if Crown’s management sold shares or not… we know that Catcha Holdings did.

Catcha Holdings filed a Form 4 in which they registered that they had 7.3M shares in Cacha Investment Corp, which had just merged with Crown LNG on the 9th.

On July 8th and 9th, the Catcha SPAC sponsors transferred or sold all of their shares.

They also filed a 13G under Crown that they owned 838,723 shares (which they sold) and approximately 7.2M warrants with an exercise price of $11.50. So, those will probably expire worthless. The point being, they sold everything they could.

Between the management team and the SPAC sponsors, around half of the stock was probably sold right when it listed on the Nasdaq.

While it’s certainly not great to see, this doesn’t necessarily mean the company will fail, either. I have enough reasons to avoid the company outside of all of the potential insider selling anyway.

Even after this dramatic sell-off in the stock…

My objections to investing in Crown LNG remain the same as they were when I made my YouTube video about the company:

Assuming everything goes well, the company won’t generate revenue until 2027. That’s a significant opportunity cost. I could deal with that, but…

Capital-intensive LNG infrastructure projects, like any projects of this scale, tend to be delayed and over budget.

If anything goes wrong (these projects almost always have problems) and they need more money… getting additional financing could be challenging.

We’ve already seen that last bullet point play out because of the collapse of their stock price. Raising capital through the stock market would be incredibly dilutive to early investors unless the stock recovered.

For the sake of investors that bought in early, I hope Crown succeeds.

With that said, I have no interest in taking a chance on this company when I could continue to invest in less capital-intensive businesses with higher probabilities of success (in my opinion).

Disclaimer

The owner of Green Investing is not a licensed investment professional. Nothing produced under the Green Investing brand should be construed as investment advice. My content is made for entertainment and educational purposes. Do your own research.